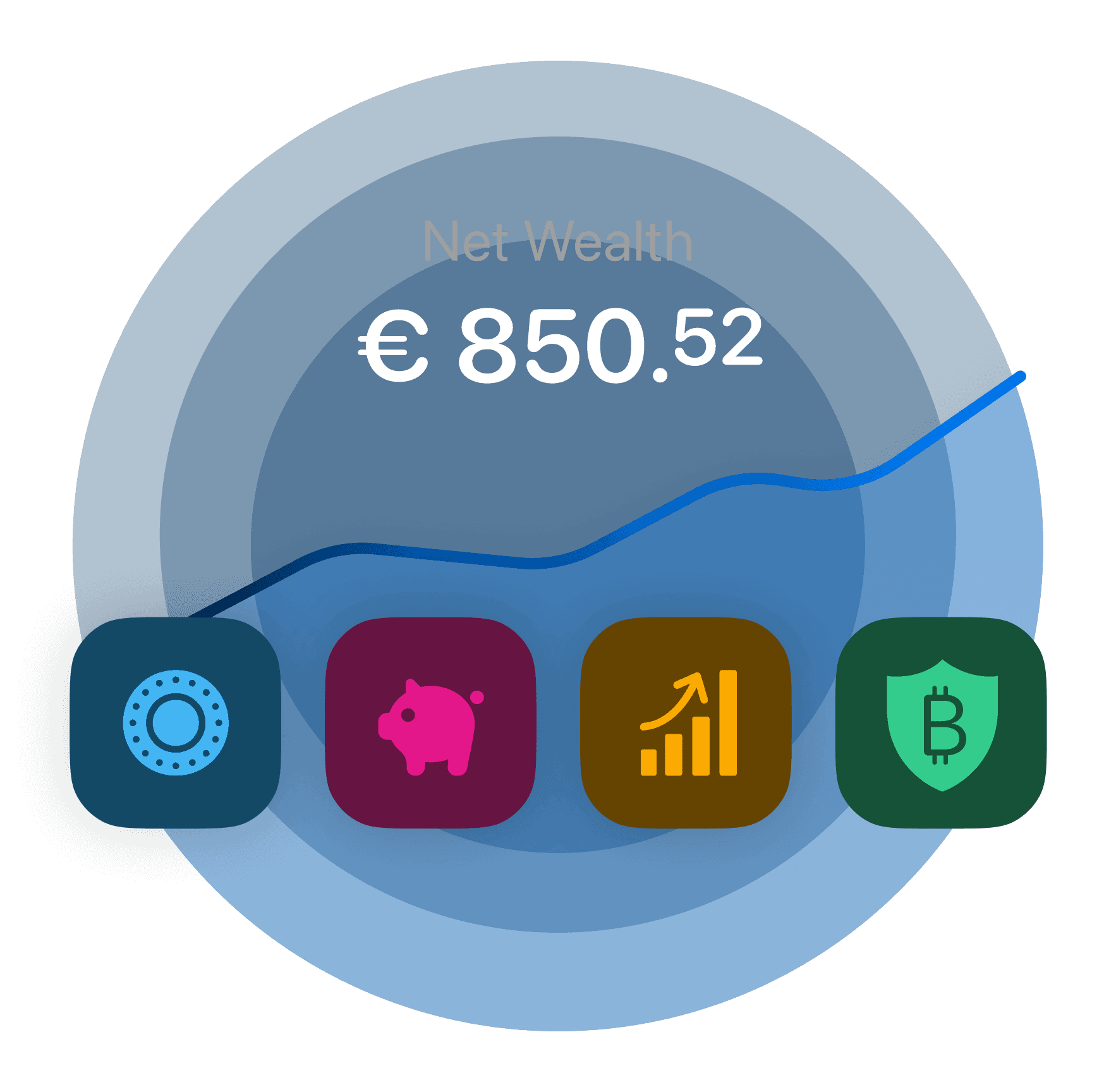

Track your wealth. Grow it confidently.

Get a complete view of everything you own—savings, stocks, crypto, and spending accounts—all in one place. Track your total wealth in real time and discover smart ways to grow it effortlessly.

Track your wealth. Grow it confidently.

Get a complete view of everything you own—savings, stocks, crypto, and spending accounts—all in one place. Track your total wealth in real time and discover smart ways to grow it effortlessly.

Track your wealth. Grow it confidently.

Get a complete view of everything you own—savings, stocks, crypto, and spending accounts—all in one place. Track your total wealth in real time and discover smart ways to grow it effortlessly.

One app for your entire financial life

Your total wealth, updated every second: spending, savings, and investments. See your progress instantly—no spreadsheets needed.

One app for your entire financial life

Your total wealth, updated every second: spending, savings, and investments. See your progress instantly—no spreadsheets needed.

One app for your entire financial life

Your total wealth, updated every second: spending, savings, and investments. See your progress instantly—no spreadsheets needed.

Savings

Stocks

Crypto

High-interest savings made effortless

Earn up to 2.01%* annual interest with weekly payouts. Secure, simple, and designed to grow your money.

Savings

Stocks

Crypto

High-interest savings made effortless

Earn up to 2.01%* annual interest with weekly payouts. Secure, simple, and designed to grow your money.

Savings

Stocks

Crypto

High-interest savings made effortless

Earn up to 2.01%* annual interest with weekly payouts. Secure, simple, and designed to grow your money.

Disclaimer

¹Not investment advice. Crypto trading involves risk of loss. Crypto trading provided by Payward Europe Solutions Limited t/a Kraken, authorized by the Central Bank of Ireland. Staking is unregulated, involves risk of slashing and is provided by Payward Commercial Ltd t/a Kraken.

²Not investment advice. Stocks trading involves risk of loss. Powered by Ginmon.

³When you place funds in a EUR term deposit, your money is locked for the full duration of the selected term. Only the full amount may be withdrawn—partial withdrawals aren’t possible. If you withdraw your funds before the end of the term, an early-withdrawal fee will apply. The early-withdrawal fee is 1% of the amount withdrawn for each remaining year of the term (partial year count as full), with the remaining period rounded up to the next full year. As a result, withdrawing early may reduce the amount you receive back.

Disclaimer

¹Not investment advice. Crypto trading involves risk of loss. Crypto trading provided by Payward Europe Solutions Limited t/a Kraken, authorized by the Central Bank of Ireland. Staking is unregulated, involves risk of slashing and is provided by Payward Commercial Ltd t/a Kraken.

²Not investment advice. Stocks trading involves risk of loss. Powered by Ginmon.

³When you place funds in a EUR term deposit, your money is locked for the full duration of the selected term. Only the full amount may be withdrawn—partial withdrawals aren’t possible. If you withdraw your funds before the end of the term, an early-withdrawal fee will apply. The early-withdrawal fee is 1% of the amount withdrawn for each remaining year of the term (partial year count as full), with the remaining period rounded up to the next full year. As a result, withdrawing early may reduce the amount you receive back.

Disclaimer

¹Not investment advice. Crypto trading involves risk of loss. Crypto trading provided by Payward Europe Solutions Limited t/a Kraken, authorized by the Central Bank of Ireland. Staking is unregulated, involves risk of slashing and is provided by Payward Commercial Ltd t/a Kraken.

²Not investment advice. Stocks trading involves risk of loss. Powered by Ginmon.

³When you place funds in a EUR term deposit, your money is locked for the full duration of the selected term. Only the full amount may be withdrawn—partial withdrawals aren’t possible. If you withdraw your funds before the end of the term, an early-withdrawal fee will apply. The early-withdrawal fee is 1% of the amount withdrawn for each remaining year of the term (partial year count as full), with the remaining period rounded up to the next full year. As a result, withdrawing early may reduce the amount you receive back.

Lock in a guaranteed interest rate

Earn up to 2.11% annual interest on your savings³. Set your money aside and enjoy a guaranteed rate for the term you choose.

Lock in a guaranteed interest rate

Earn up to 2.11% annual interest on your savings³. Set your money aside and enjoy a guaranteed rate for the term you choose.

Lock in a guaranteed interest rate

Earn up to 2.11% annual interest on your savings³. Set your money aside and enjoy a guaranteed rate for the term you choose.

Grow your wealth

Watch your money grow without effort. Build your budget, automate your saving and investing, and keep track of your net wealth in one place.

Grow your wealth

Watch your money grow without effort. Build your budget, automate your saving and investing, and keep track of your net wealth in one place.

Grow your wealth

Watch your money grow without effort. Build your budget, automate your saving and investing, and keep track of your net wealth in one place.

Budgeting so easy you'll actually do it!

Set up separate Bank Accounts for each spending category and let bunq do the rest—sort your salary, set limits, save automatically, and track it all with ease.

Budgeting so easy you'll actually do it!

Set up separate Bank Accounts for each spending category and let bunq do the rest—sort your salary, set limits, save automatically, and track it all with ease.

Budgeting so easy you'll actually do it!

Set up separate Bank Accounts for each spending category and let bunq do the rest—sort your salary, set limits, save automatically, and track it all with ease.

Built for safety and control

From €100,000 deposit protection to biometric access and two-factor authentication, bunq gives you robust security and instant notifications so you always know what’s happening with your money.

Built for safety and control

From €100,000 deposit protection to biometric access and two-factor authentication, bunq gives you robust security and instant notifications so you always know what’s happening with your money.

Built for safety and control

From €100,000 deposit protection to biometric access and two-factor authentication, bunq gives you robust security and instant notifications so you always know what’s happening with your money.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Frequently Asked Questions

Can I open multiple savings accounts?

Yes! With a bunq Pro or bunq Elite account, you can create up to 25 savings accounts, each with its own unique IBAN. This allows you to send and receive money independently and take full control of your budget. You can also personalize each account and group them as needed for a clear and organized financial overview.

Yes! With a bunq Pro or bunq Elite account, you can create up to 25 savings accounts, each with its own unique IBAN. This allows you to send and receive money independently and take full control of your budget. You can also personalize each account and group them as needed for a clear and organized financial overview.

How does bunq ensure my savings are safe?

Your Euro savings are protected by the Dutch Deposit Guarantee Scheme (DGS), which insures deposits up to €100,000 per account holder across all bunq accounts (excluding investments in stocks and crypto). This guarantee ensures that your money is secure while you save with bunq.

What can I do with crypto at bunq?

You can buy, hold, track, swap, and sell crypto anytime without leaving your bunq app.

Who can open a Term Deposit?

Any personal bunq user aged 18+, on any plan, can open a Term Deposit. Business accounts are not eligible. Learn more

Frequently Asked Questions

Can I open multiple savings accounts?

Yes! With a bunq Pro or bunq Elite account, you can create up to 25 savings accounts, each with its own unique IBAN. This allows you to send and receive money independently and take full control of your budget. You can also personalize each account and group them as needed for a clear and organized financial overview.

Yes! With a bunq Pro or bunq Elite account, you can create up to 25 savings accounts, each with its own unique IBAN. This allows you to send and receive money independently and take full control of your budget. You can also personalize each account and group them as needed for a clear and organized financial overview.

How does bunq ensure my savings are safe?

Your Euro savings are protected by the Dutch Deposit Guarantee Scheme (DGS), which insures deposits up to €100,000 per account holder across all bunq accounts (excluding investments in stocks and crypto). This guarantee ensures that your money is secure while you save with bunq.

What can I do with crypto at bunq?

You can buy, hold, track, swap, and sell crypto anytime without leaving your bunq app.

Who can open a Term Deposit?

Any personal bunq user aged 18+, on any plan, can open a Term Deposit. Business accounts are not eligible. Learn more

Frequently Asked Questions

Can I open multiple savings accounts?

Yes! With a bunq Pro or bunq Elite account, you can create up to 25 savings accounts, each with its own unique IBAN. This allows you to send and receive money independently and take full control of your budget. You can also personalize each account and group them as needed for a clear and organized financial overview.

Yes! With a bunq Pro or bunq Elite account, you can create up to 25 savings accounts, each with its own unique IBAN. This allows you to send and receive money independently and take full control of your budget. You can also personalize each account and group them as needed for a clear and organized financial overview.

How does bunq ensure my savings are safe?

Your Euro savings are protected by the Dutch Deposit Guarantee Scheme (DGS), which insures deposits up to €100,000 per account holder across all bunq accounts (excluding investments in stocks and crypto). This guarantee ensures that your money is secure while you save with bunq.

What can I do with crypto at bunq?

You can buy, hold, track, swap, and sell crypto anytime without leaving your bunq app.

Who can open a Term Deposit?

Any personal bunq user aged 18+, on any plan, can open a Term Deposit. Business accounts are not eligible. Learn more

Choose your plan

Try it free for 30 days, no strings attached.

bunq Free

Free

The essentials to get you started.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account that makes budgeting easy.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Choose your plan

Try it free for 30 days, no strings attached.

bunq Free

Free

The essentials to get you started.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account that makes budgeting easy.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Choose your plan

Try it free for 30 days, no strings attached.

bunq Free

Free

The essentials to get you started.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account that makes budgeting easy.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Build your wealth with bunq

Join millions already saving, investing, and growing their money with bunq—all in one app built for your financial freedom.

Build your wealth with bunq

Join millions already saving, investing, and growing their money with bunq—all in one app built for your financial freedom.

Build your wealth with bunq

Join millions already saving, investing, and growing their money with bunq—all in one app built for your financial freedom.

Related Articles

Check out some of these blog posts, packed with useful insights and tips to help you bank smarter and make life easy.

Related Articles

Check out some of these blog posts, packed with useful insights and tips to help you bank smarter and make life easy.

Related Articles

Check out some of these blog posts, packed with useful insights and tips to help you bank smarter and make life easy.