bunq Core

The bank account for everyday use.

bunq Core

The bank account for everyday use.

bunq Core

The bank account for everyday use.

Your new bank account, ready in just 5 minutes

100% online - no branch visits, no paperwork

Just download the bunq app and sign up from anywhere.

Start without a tax ID

No tax ID? No problem. Start banking right away and provide it within 90 days.

Earn up to 2.01% interest - paid out weekly

Boost your savings with 2.01% interest on EUR, and 3.01% on USD and GBP

Your new bank account, ready in just 5 minutes

100% online - no branch visits, no paperwork

Just download the bunq app and sign up from anywhere.

Start without a tax ID

No tax ID? No problem. Start banking right away and provide it within 90 days.

Earn up to 2.01% interest - paid out weekly

Boost your savings with 2.01% interest on EUR, and 3.01% on USD and GBP

Your new bank account, ready in just 5 minutes

100% online - no branch visits, no paperwork

Just download the bunq app and sign up from anywhere.

Start without a tax ID

No tax ID? No problem. Start banking right away and provide it within 90 days.

Earn up to 2.01% interest - paid out weekly

Boost your savings with 2.01% interest on EUR, and 3.01% on USD and GBP

Bank account & Savings account

Take your budgeting to the next level by organizing your finances with up to 5 dedicated money pots. Each with a unique IBAN, so you can easily transfer money and even use them for direct debits.

Bank account & Savings account

Take your budgeting to the next level by organizing your finances with up to 5 dedicated money pots. Each with a unique IBAN, so you can easily transfer money and even use them for direct debits.

Bank account & Savings account

Take your budgeting to the next level by organizing your finances with up to 5 dedicated money pots. Each with a unique IBAN, so you can easily transfer money and even use them for direct debits.

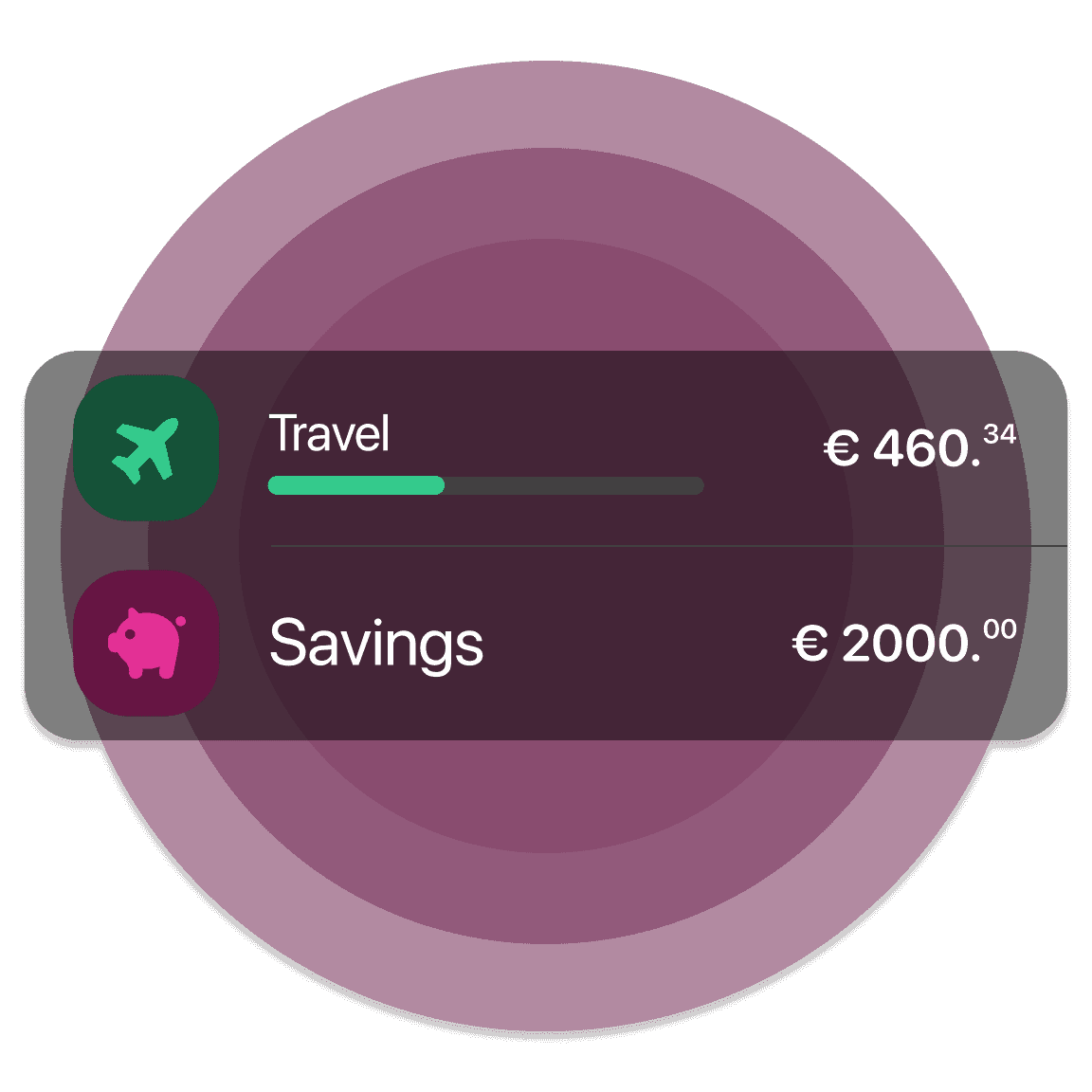

2.01%* interest paid out weekly

Make your savings grow faster with a highly competitive interest rate. Earnings get paid out weekly, so you benefit from compound interest and reach your goals even quicker.

2.01%* interest paid out weekly

Make your savings grow faster with a highly competitive interest rate. Earnings get paid out weekly, so you benefit from compound interest and reach your goals even quicker.

2.01%* interest paid out weekly

Make your savings grow faster with a highly competitive interest rate. Earnings get paid out weekly, so you benefit from compound interest and reach your goals even quicker.

Get your Cards

With bunq Core, get 1 Digital Card and 1 Physical Card. Get it, top it up and instantly start making payments online or with your phone.

Get your Cards

With bunq Core, get 1 Digital Card and 1 Physical Card. Get it, top it up and instantly start making payments online or with your phone.

Get your Cards

With bunq Core, get 1 Digital Card and 1 Physical Card. Get it, top it up and instantly start making payments online or with your phone.

Effortless payment management

Simplify outgoing payments with AutoAccept and Scheduled Payments. Automatically approve requests from trusted contacts and allow them to schedule payments in advance.

Effortless payment management

Simplify outgoing payments with AutoAccept and Scheduled Payments. Automatically approve requests from trusted contacts and allow them to schedule payments in advance.

Effortless payment management

Simplify outgoing payments with AutoAccept and Scheduled Payments. Automatically approve requests from trusted contacts and allow them to schedule payments in advance.

Get the best exchange rate abroad

Spend smarter with ZeroFX. Use your bunq bank debit or credit card to get great value on purchases in currencies outside the Eurozone.

Get the best exchange rate abroad

Spend smarter with ZeroFX. Use your bunq bank debit or credit card to get great value on purchases in currencies outside the Eurozone.

Get the best exchange rate abroad

Spend smarter with ZeroFX. Use your bunq bank debit or credit card to get great value on purchases in currencies outside the Eurozone.

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility.

Buy & sell crypto, right where you bank

Get started with crypto right from your bunq app, with industry-leading protection* every step of the way. Choose from the top cryptocurrencies—buying and selling takes just a tap.

Buy & sell crypto, right where you bank

Get started with crypto right from your bunq app, with industry-leading protection* every step of the way. Choose from the top cryptocurrencies—buying and selling takes just a tap.

Buy & sell crypto, right where you bank

Get started with crypto right from your bunq app, with industry-leading protection* every step of the way. Choose from the top cryptocurrencies—buying and selling takes just a tap.

Get instant support, 24/7

Got a question? Get all the answers you need in seconds. Chat in your language at any hour, wherever you are.

Get instant support, 24/7

Got a question? Get all the answers you need in seconds. Chat in your language at any hour, wherever you are.

Get instant support, 24/7

Got a question? Get all the answers you need in seconds. Chat in your language at any hour, wherever you are.

Disclaimer

*Powered by Kraken's Custody service and bunq's Safety Shield.

Disclaimer

*Powered by Kraken's Custody service and bunq's Safety Shield.

Disclaimer

*Powered by Kraken's Custody service and bunq's Safety Shield.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Frequently Asked Questions

What are the main features of bunq Core bank account?

bunq Core is a bank account for everyday use, offering high interest on savings and features designed to make life easier. You can open an account in just 5 minutes, with pricing at €3.99/month for Personal

💸 Essential Banking Features

5 Bank Accounts – Choose between a Savings Account, Multi-currency Savings, Foreign Currency Bank Account, Joint Bank Account, or a regular Bank Account.

1 Physical Card (Free) – Mastercard Credit or Debit (excluding Metal Card Credit). Additional cards cost €3.49/month per card.

1 Digital Card – Instantly available for Apple Pay or Google Pay.

ZeroFX – Exchange up to €1,000 per year with zero fees.

Transfers in Different Currencies – Send money abroad effortlessly.

Instant Payments – Make and receive payments instantly.

(Instant) IBAN to IBAN Transfers – Move money quickly across accounts.

Scheduled Payments & Requests – Automate transactions for peace of mind.

bunq.me Requests – Get paid faster with personalized payment links.

Apple & Google Pay – Pay seamlessly with your phone.

Tap to Pay – Accept payments directly on your iPhone.

ATM Withdrawals – 5x for €0.99 each, then €2.99 each after the limit.

📈 Grow Your Money

MassInterest, paid weekly, on savings up to €100,000:

Up to 2.01% for 🇪🇺 EEA residents.

3.01% for savings in 🇺🇸USD and 🇬🇧GBP.

Stocks – Start investing from just €10 within the bunq app.

🌱 Make an Impact

• Planting Trees as You Go – For every €1,000 spent with your bunq card, a tree is planted to help offset your CO2 footprint.

👨👩👧👦 Shared & Family Banking

Joint Savings Account – Save together with others.

Joint Bank Account – Manage shared finances effortlessly.

Child Account – A secure account for your child.

Parent Access – Free access to your child’s bunq account.

bunq Pack – Share a bunq plan with family or friends.

Group Expenses – Easily track and split costs with others.

Shared Access – Give trusted people access to your account.

🚀 Extra Perks & Convenience

bunq Web – Manage your banking from any device.

Switch Service – Move your banking to bunq hassle-free.

True Name – Use the name that represents you.

Loyalty Cards – Store all your loyalty cards in one place.

Freedom of Choice – Customize your banking experience.

App Translation – Use the bunq app in your language.

🔒 Security & Peace of Mind

Biometric ID – Secure login with fingerprint or Face ID.

Deposit Protection – Your funds are safe and insured.

Instant Notifications – Stay updated on all transactions.

24/7 Support & SOS Hotline – Help is always available.

bunq Core is a bank account for everyday use, offering high interest on savings and features designed to make life easier. You can open an account in just 5 minutes, with pricing at €3.99/month for Personal

💸 Essential Banking Features

5 Bank Accounts – Choose between a Savings Account, Multi-currency Savings, Foreign Currency Bank Account, Joint Bank Account, or a regular Bank Account.

1 Physical Card (Free) – Mastercard Credit or Debit (excluding Metal Card Credit). Additional cards cost €3.49/month per card.

1 Digital Card – Instantly available for Apple Pay or Google Pay.

ZeroFX – Exchange up to €1,000 per year with zero fees.

Transfers in Different Currencies – Send money abroad effortlessly.

Instant Payments – Make and receive payments instantly.

(Instant) IBAN to IBAN Transfers – Move money quickly across accounts.

Scheduled Payments & Requests – Automate transactions for peace of mind.

bunq.me Requests – Get paid faster with personalized payment links.

Apple & Google Pay – Pay seamlessly with your phone.

Tap to Pay – Accept payments directly on your iPhone.

ATM Withdrawals – 5x for €0.99 each, then €2.99 each after the limit.

📈 Grow Your Money

MassInterest, paid weekly, on savings up to €100,000:

Up to 2.01% for 🇪🇺 EEA residents.

3.01% for savings in 🇺🇸USD and 🇬🇧GBP.

Stocks – Start investing from just €10 within the bunq app.

🌱 Make an Impact

• Planting Trees as You Go – For every €1,000 spent with your bunq card, a tree is planted to help offset your CO2 footprint.

👨👩👧👦 Shared & Family Banking

Joint Savings Account – Save together with others.

Joint Bank Account – Manage shared finances effortlessly.

Child Account – A secure account for your child.

Parent Access – Free access to your child’s bunq account.

bunq Pack – Share a bunq plan with family or friends.

Group Expenses – Easily track and split costs with others.

Shared Access – Give trusted people access to your account.

🚀 Extra Perks & Convenience

bunq Web – Manage your banking from any device.

Switch Service – Move your banking to bunq hassle-free.

True Name – Use the name that represents you.

Loyalty Cards – Store all your loyalty cards in one place.

Freedom of Choice – Customize your banking experience.

App Translation – Use the bunq app in your language.

🔒 Security & Peace of Mind

Biometric ID – Secure login with fingerprint or Face ID.

Deposit Protection – Your funds are safe and insured.

Instant Notifications – Stay updated on all transactions.

24/7 Support & SOS Hotline – Help is always available.

Can I also switch to another account at a later stage?

Of course, to truly experience life without the hassle of money admin you can always switch to bunq Free, bunq Core, bunq Pro or bunq Elite in seconds. ✨

How does bunq help me in budgeting?

Whether you're planning for a big purchase, saving for a rainy day, or simply want to keep a close eye on your daily spending, the Budgeting tab is designed to make budgeting so easy you’ll actually do it. With just a tap in the app, you get instant access to spending category breakdowns and monthly comparisons, and you easily set up smart automations that help you save.

The Budgeting tab allows you to easily compare with previous months, making it a powerful tool for managing your finances. You can view your spending per category and easily set spending limits. When you’ve spent 80%, 95% or 100% of a spending limit, the bunq app will send you a notification, making it easier to stay on budget without having to think about it.

Effortlessly grow your Savings Account or invest in Stocks! With Auto Round Up, every outgoing payment, including payments from Joint and Connected Accounts, is rounded up to the nearest €1, €2 or €5,. The difference between the payment and the rounded-up amount is automatically transferred to your Savings Account or invested in the Stock of your choice 💸

With Organize Your Income, you can automatically organize your budget every time you get paid. Sort your salary into categories like bills, savings, daily expenses, or even invest into Stocks. This saves you time and effort so you always have enough set aside for essentials like rent, utilities, or groceries. You’ll be able to consistently invest in Stocks to build your assets without having to think about it

How does bunq protect my bank account?

At bunq, your security is our absolute priority. Throughout our entire history, not a single cent has been lost due to a security breach. Our state-of-the-art security systems are designed to protect you and your money at all times.

Real-time monitoring: Our systems constantly watch for suspicious activity.

Instant account lockdown: If anything seems out of the ordinary, we can quickly secure your account to prevent unauthorized access.

Robust security protocols: We follow industry-leading best practices and continuously update our systems to ensure your data and money remain protected.

Want to learn more? Follow this link.

Frequently Asked Questions

What are the main features of bunq Core bank account?

bunq Core is a bank account for everyday use, offering high interest on savings and features designed to make life easier. You can open an account in just 5 minutes, with pricing at €3.99/month for Personal

💸 Essential Banking Features

5 Bank Accounts – Choose between a Savings Account, Multi-currency Savings, Foreign Currency Bank Account, Joint Bank Account, or a regular Bank Account.

1 Physical Card (Free) – Mastercard Credit or Debit (excluding Metal Card Credit). Additional cards cost €3.49/month per card.

1 Digital Card – Instantly available for Apple Pay or Google Pay.

ZeroFX – Exchange up to €1,000 per year with zero fees.

Transfers in Different Currencies – Send money abroad effortlessly.

Instant Payments – Make and receive payments instantly.

(Instant) IBAN to IBAN Transfers – Move money quickly across accounts.

Scheduled Payments & Requests – Automate transactions for peace of mind.

bunq.me Requests – Get paid faster with personalized payment links.

Apple & Google Pay – Pay seamlessly with your phone.

Tap to Pay – Accept payments directly on your iPhone.

ATM Withdrawals – 5x for €0.99 each, then €2.99 each after the limit.

📈 Grow Your Money

MassInterest, paid weekly, on savings up to €100,000:

Up to 2.01% for 🇪🇺 EEA residents.

3.01% for savings in 🇺🇸USD and 🇬🇧GBP.

Stocks – Start investing from just €10 within the bunq app.

🌱 Make an Impact

• Planting Trees as You Go – For every €1,000 spent with your bunq card, a tree is planted to help offset your CO2 footprint.

👨👩👧👦 Shared & Family Banking

Joint Savings Account – Save together with others.

Joint Bank Account – Manage shared finances effortlessly.

Child Account – A secure account for your child.

Parent Access – Free access to your child’s bunq account.

bunq Pack – Share a bunq plan with family or friends.

Group Expenses – Easily track and split costs with others.

Shared Access – Give trusted people access to your account.

🚀 Extra Perks & Convenience

bunq Web – Manage your banking from any device.

Switch Service – Move your banking to bunq hassle-free.

True Name – Use the name that represents you.

Loyalty Cards – Store all your loyalty cards in one place.

Freedom of Choice – Customize your banking experience.

App Translation – Use the bunq app in your language.

🔒 Security & Peace of Mind

Biometric ID – Secure login with fingerprint or Face ID.

Deposit Protection – Your funds are safe and insured.

Instant Notifications – Stay updated on all transactions.

24/7 Support & SOS Hotline – Help is always available.

bunq Core is a bank account for everyday use, offering high interest on savings and features designed to make life easier. You can open an account in just 5 minutes, with pricing at €3.99/month for Personal

💸 Essential Banking Features

5 Bank Accounts – Choose between a Savings Account, Multi-currency Savings, Foreign Currency Bank Account, Joint Bank Account, or a regular Bank Account.

1 Physical Card (Free) – Mastercard Credit or Debit (excluding Metal Card Credit). Additional cards cost €3.49/month per card.

1 Digital Card – Instantly available for Apple Pay or Google Pay.

ZeroFX – Exchange up to €1,000 per year with zero fees.

Transfers in Different Currencies – Send money abroad effortlessly.

Instant Payments – Make and receive payments instantly.

(Instant) IBAN to IBAN Transfers – Move money quickly across accounts.

Scheduled Payments & Requests – Automate transactions for peace of mind.

bunq.me Requests – Get paid faster with personalized payment links.

Apple & Google Pay – Pay seamlessly with your phone.

Tap to Pay – Accept payments directly on your iPhone.

ATM Withdrawals – 5x for €0.99 each, then €2.99 each after the limit.

📈 Grow Your Money

MassInterest, paid weekly, on savings up to €100,000:

Up to 2.01% for 🇪🇺 EEA residents.

3.01% for savings in 🇺🇸USD and 🇬🇧GBP.

Stocks – Start investing from just €10 within the bunq app.

🌱 Make an Impact

• Planting Trees as You Go – For every €1,000 spent with your bunq card, a tree is planted to help offset your CO2 footprint.

👨👩👧👦 Shared & Family Banking

Joint Savings Account – Save together with others.

Joint Bank Account – Manage shared finances effortlessly.

Child Account – A secure account for your child.

Parent Access – Free access to your child’s bunq account.

bunq Pack – Share a bunq plan with family or friends.

Group Expenses – Easily track and split costs with others.

Shared Access – Give trusted people access to your account.

🚀 Extra Perks & Convenience

bunq Web – Manage your banking from any device.

Switch Service – Move your banking to bunq hassle-free.

True Name – Use the name that represents you.

Loyalty Cards – Store all your loyalty cards in one place.

Freedom of Choice – Customize your banking experience.

App Translation – Use the bunq app in your language.

🔒 Security & Peace of Mind

Biometric ID – Secure login with fingerprint or Face ID.

Deposit Protection – Your funds are safe and insured.

Instant Notifications – Stay updated on all transactions.

24/7 Support & SOS Hotline – Help is always available.

Can I also switch to another account at a later stage?

Of course, to truly experience life without the hassle of money admin you can always switch to bunq Free, bunq Core, bunq Pro or bunq Elite in seconds. ✨

How does bunq help me in budgeting?

Whether you're planning for a big purchase, saving for a rainy day, or simply want to keep a close eye on your daily spending, the Budgeting tab is designed to make budgeting so easy you’ll actually do it. With just a tap in the app, you get instant access to spending category breakdowns and monthly comparisons, and you easily set up smart automations that help you save.

The Budgeting tab allows you to easily compare with previous months, making it a powerful tool for managing your finances. You can view your spending per category and easily set spending limits. When you’ve spent 80%, 95% or 100% of a spending limit, the bunq app will send you a notification, making it easier to stay on budget without having to think about it.

Effortlessly grow your Savings Account or invest in Stocks! With Auto Round Up, every outgoing payment, including payments from Joint and Connected Accounts, is rounded up to the nearest €1, €2 or €5,. The difference between the payment and the rounded-up amount is automatically transferred to your Savings Account or invested in the Stock of your choice 💸

With Organize Your Income, you can automatically organize your budget every time you get paid. Sort your salary into categories like bills, savings, daily expenses, or even invest into Stocks. This saves you time and effort so you always have enough set aside for essentials like rent, utilities, or groceries. You’ll be able to consistently invest in Stocks to build your assets without having to think about it

How does bunq protect my bank account?

At bunq, your security is our absolute priority. Throughout our entire history, not a single cent has been lost due to a security breach. Our state-of-the-art security systems are designed to protect you and your money at all times.

Real-time monitoring: Our systems constantly watch for suspicious activity.

Instant account lockdown: If anything seems out of the ordinary, we can quickly secure your account to prevent unauthorized access.

Robust security protocols: We follow industry-leading best practices and continuously update our systems to ensure your data and money remain protected.

Want to learn more? Follow this link.

Frequently Asked Questions

What are the main features of bunq Core bank account?

bunq Core is a bank account for everyday use, offering high interest on savings and features designed to make life easier. You can open an account in just 5 minutes, with pricing at €3.99/month for Personal

💸 Essential Banking Features

5 Bank Accounts – Choose between a Savings Account, Multi-currency Savings, Foreign Currency Bank Account, Joint Bank Account, or a regular Bank Account.

1 Physical Card (Free) – Mastercard Credit or Debit (excluding Metal Card Credit). Additional cards cost €3.49/month per card.

1 Digital Card – Instantly available for Apple Pay or Google Pay.

ZeroFX – Exchange up to €1,000 per year with zero fees.

Transfers in Different Currencies – Send money abroad effortlessly.

Instant Payments – Make and receive payments instantly.

(Instant) IBAN to IBAN Transfers – Move money quickly across accounts.

Scheduled Payments & Requests – Automate transactions for peace of mind.

bunq.me Requests – Get paid faster with personalized payment links.

Apple & Google Pay – Pay seamlessly with your phone.

Tap to Pay – Accept payments directly on your iPhone.

ATM Withdrawals – 5x for €0.99 each, then €2.99 each after the limit.

📈 Grow Your Money

MassInterest, paid weekly, on savings up to €100,000:

Up to 2.01% for 🇪🇺 EEA residents.

3.01% for savings in 🇺🇸USD and 🇬🇧GBP.

Stocks – Start investing from just €10 within the bunq app.

🌱 Make an Impact

• Planting Trees as You Go – For every €1,000 spent with your bunq card, a tree is planted to help offset your CO2 footprint.

👨👩👧👦 Shared & Family Banking

Joint Savings Account – Save together with others.

Joint Bank Account – Manage shared finances effortlessly.

Child Account – A secure account for your child.

Parent Access – Free access to your child’s bunq account.

bunq Pack – Share a bunq plan with family or friends.

Group Expenses – Easily track and split costs with others.

Shared Access – Give trusted people access to your account.

🚀 Extra Perks & Convenience

bunq Web – Manage your banking from any device.

Switch Service – Move your banking to bunq hassle-free.

True Name – Use the name that represents you.

Loyalty Cards – Store all your loyalty cards in one place.

Freedom of Choice – Customize your banking experience.

App Translation – Use the bunq app in your language.

🔒 Security & Peace of Mind

Biometric ID – Secure login with fingerprint or Face ID.

Deposit Protection – Your funds are safe and insured.

Instant Notifications – Stay updated on all transactions.

24/7 Support & SOS Hotline – Help is always available.

bunq Core is a bank account for everyday use, offering high interest on savings and features designed to make life easier. You can open an account in just 5 minutes, with pricing at €3.99/month for Personal

💸 Essential Banking Features

5 Bank Accounts – Choose between a Savings Account, Multi-currency Savings, Foreign Currency Bank Account, Joint Bank Account, or a regular Bank Account.

1 Physical Card (Free) – Mastercard Credit or Debit (excluding Metal Card Credit). Additional cards cost €3.49/month per card.

1 Digital Card – Instantly available for Apple Pay or Google Pay.

ZeroFX – Exchange up to €1,000 per year with zero fees.

Transfers in Different Currencies – Send money abroad effortlessly.

Instant Payments – Make and receive payments instantly.

(Instant) IBAN to IBAN Transfers – Move money quickly across accounts.

Scheduled Payments & Requests – Automate transactions for peace of mind.

bunq.me Requests – Get paid faster with personalized payment links.

Apple & Google Pay – Pay seamlessly with your phone.

Tap to Pay – Accept payments directly on your iPhone.

ATM Withdrawals – 5x for €0.99 each, then €2.99 each after the limit.

📈 Grow Your Money

MassInterest, paid weekly, on savings up to €100,000:

Up to 2.01% for 🇪🇺 EEA residents.

3.01% for savings in 🇺🇸USD and 🇬🇧GBP.

Stocks – Start investing from just €10 within the bunq app.

🌱 Make an Impact

• Planting Trees as You Go – For every €1,000 spent with your bunq card, a tree is planted to help offset your CO2 footprint.

👨👩👧👦 Shared & Family Banking

Joint Savings Account – Save together with others.

Joint Bank Account – Manage shared finances effortlessly.

Child Account – A secure account for your child.

Parent Access – Free access to your child’s bunq account.

bunq Pack – Share a bunq plan with family or friends.

Group Expenses – Easily track and split costs with others.

Shared Access – Give trusted people access to your account.

🚀 Extra Perks & Convenience

bunq Web – Manage your banking from any device.

Switch Service – Move your banking to bunq hassle-free.

True Name – Use the name that represents you.

Loyalty Cards – Store all your loyalty cards in one place.

Freedom of Choice – Customize your banking experience.

App Translation – Use the bunq app in your language.

🔒 Security & Peace of Mind

Biometric ID – Secure login with fingerprint or Face ID.

Deposit Protection – Your funds are safe and insured.

Instant Notifications – Stay updated on all transactions.

24/7 Support & SOS Hotline – Help is always available.

Can I also switch to another account at a later stage?

Of course, to truly experience life without the hassle of money admin you can always switch to bunq Free, bunq Core, bunq Pro or bunq Elite in seconds. ✨

How does bunq help me in budgeting?

Whether you're planning for a big purchase, saving for a rainy day, or simply want to keep a close eye on your daily spending, the Budgeting tab is designed to make budgeting so easy you’ll actually do it. With just a tap in the app, you get instant access to spending category breakdowns and monthly comparisons, and you easily set up smart automations that help you save.

The Budgeting tab allows you to easily compare with previous months, making it a powerful tool for managing your finances. You can view your spending per category and easily set spending limits. When you’ve spent 80%, 95% or 100% of a spending limit, the bunq app will send you a notification, making it easier to stay on budget without having to think about it.

Effortlessly grow your Savings Account or invest in Stocks! With Auto Round Up, every outgoing payment, including payments from Joint and Connected Accounts, is rounded up to the nearest €1, €2 or €5,. The difference between the payment and the rounded-up amount is automatically transferred to your Savings Account or invested in the Stock of your choice 💸

With Organize Your Income, you can automatically organize your budget every time you get paid. Sort your salary into categories like bills, savings, daily expenses, or even invest into Stocks. This saves you time and effort so you always have enough set aside for essentials like rent, utilities, or groceries. You’ll be able to consistently invest in Stocks to build your assets without having to think about it

How does bunq protect my bank account?

At bunq, your security is our absolute priority. Throughout our entire history, not a single cent has been lost due to a security breach. Our state-of-the-art security systems are designed to protect you and your money at all times.

Real-time monitoring: Our systems constantly watch for suspicious activity.

Instant account lockdown: If anything seems out of the ordinary, we can quickly secure your account to prevent unauthorized access.

Robust security protocols: We follow industry-leading best practices and continuously update our systems to ensure your data and money remain protected.

Want to learn more? Follow this link.

Compare our plans

Try it free for 30 days, no strings attached.

bunq Free

Free

The essentials to get you started.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account that makes budgeting easy.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Compare our plans

Try it free for 30 days, no strings attached.

bunq Free

Free

The essentials to get you started.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account that makes budgeting easy.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Compare our plans

Try it free for 30 days, no strings attached.

bunq Free

Free

The essentials to get you started.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account that makes budgeting easy.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Related Articles

Check out some of these blog posts, packed with useful insights and tips to help you bank smarter and make life easy.

Related Articles

Check out some of these blog posts, packed with useful insights and tips to help you bank smarter and make life easy.

Related Articles

Check out some of these blog posts, packed with useful insights and tips to help you bank smarter and make life easy.