Your savings perfectly organized

Earn 2.01% annual interest, round up purchases automatically, and have incoming money flow to the right pot—so growing your savings is clearer, faster, simpler.

Your savings perfectly organized

Earn 2.01% annual interest, round up purchases automatically, and have incoming money flow to the right pot—so growing your savings is clearer, faster, simpler.

Your savings perfectly organized

Earn 2.01% annual interest, round up purchases automatically, and have incoming money flow to the right pot—so growing your savings is clearer, faster, simpler.

Savings Accounts

Earn 2.01% annual interest on your deposits.

Foreign Currency Savings Accounts

Earn up to 3.01% annual interest on USD/GBP and up to 27% on other 6 currencies.

Term Deposits

Lock in a guaranteed interest rate

Auto Round Up

Round up payments and save the difference.

Organize Your Income

Sort incoming payments, automatically.

Joint Savings Accounts

Save together effortlessly. Earn 2.01% annual interest on your shared savings.

Savings Accounts

Earn 2.01% annual interest on your deposits.

Foreign Currency Savings Accounts

Earn up to 3.01% annual interest on USD/GBP and up to 27% on other 6 currencies.

Term Deposits

Lock in a guaranteed interest rate

Auto Round Up

Round up payments and save the difference.

Organize Your Income

Sort incoming payments, automatically.

Joint Savings Accounts

Save together effortlessly. Earn 2.01% annual interest on your shared savings.

Savings Accounts

Earn 2.01% annual interest on your deposits.

Foreign Currency Savings Accounts

Earn up to 3.01% annual interest on USD/GBP and up to 27% on other 6 currencies.

Term Deposits

Lock in a guaranteed interest rate

Auto Round Up

Round up payments and save the difference.

Organize Your Income

Sort incoming payments, automatically.

Joint Savings Accounts

Save together effortlessly. Earn 2.01% annual interest on your shared savings.

2.01%* annual interest paid out weekly

Grow your savings faster with a high-interest rate. Earn weekly payouts and take advantage of compound interest, helping you reach your goals even quicker.

2.01%* annual interest paid out weekly

Grow your savings faster with a high-interest rate. Earn weekly payouts and take advantage of compound interest, helping you reach your goals even quicker.

2.01%* annual interest paid out weekly

Grow your savings faster with a high-interest rate. Earn weekly payouts and take advantage of compound interest, helping you reach your goals even quicker.

Disclaimer

¹Exchange rates, interest rates, and inflation can change at any time. When you hold money in a foreign-currency e-money account, the value of your balance may rise or fall relative to your home currency, meaning you may receive back less in your home currency than you originally deposited. Interest on foreign-currency balances is earned in those currencies up to the equivalent of €100,000 per user, based on applicable conversion rates. Your foreign-currency e-money accounts are issued and safeguarded by CurrencyCloud and are not protected by a deposit guarantee scheme. Learn More

Disclaimer

¹Exchange rates, interest rates, and inflation can change at any time. When you hold money in a foreign-currency e-money account, the value of your balance may rise or fall relative to your home currency, meaning you may receive back less in your home currency than you originally deposited. Interest on foreign-currency balances is earned in those currencies up to the equivalent of €100,000 per user, based on applicable conversion rates. Your foreign-currency e-money accounts are issued and safeguarded by CurrencyCloud and are not protected by a deposit guarantee scheme. Learn More

Disclaimer

¹Exchange rates, interest rates, and inflation can change at any time. When you hold money in a foreign-currency e-money account, the value of your balance may rise or fall relative to your home currency, meaning you may receive back less in your home currency than you originally deposited. Interest on foreign-currency balances is earned in those currencies up to the equivalent of €100,000 per user, based on applicable conversion rates. Your foreign-currency e-money accounts are issued and safeguarded by CurrencyCloud and are not protected by a deposit guarantee scheme. Learn More

Grow your savings with Foreign Currency Savings Accounts

Earn high interest across 8 global currencies with bunq. Get up to 3.01% annual interest on USD and GBP, and up to 29% annual interest on selected global currencies like TRY, PLN, and ZAR—all paid out weekly¹.

Grow your savings with Foreign Currency Savings Accounts

Earn high interest across 8 global currencies with bunq. Get up to 3.01% annual interest on USD and GBP, and up to 29% annual interest on selected global currencies like TRY, PLN, and ZAR—all paid out weekly¹.

Grow your savings with Foreign Currency Savings Accounts

Earn high interest across 8 global currencies with bunq. Get up to 3.01% annual interest on USD and GBP, and up to 29% annual interest on selected global currencies like TRY, PLN, and ZAR—all paid out weekly¹.

Lock in a guaranteed interest rate

Earn up to 2.11% annual interest on your savings. Set your money aside and enjoy a guaranteed rate for the term you choose.

Lock in a guaranteed interest rate

Earn up to 2.11% annual interest on your savings. Set your money aside and enjoy a guaranteed rate for the term you choose.

Lock in a guaranteed interest rate

Earn up to 2.11% annual interest on your savings. Set your money aside and enjoy a guaranteed rate for the term you choose.

Save the change

Auto Round Up adds your spare change to your Savings Account every time you pay. Spend €2.20 on coffee? €0.80 goes straight into your Savings Account, helping you grow your money effortlessly with compound interest.

Save the change

Auto Round Up adds your spare change to your Savings Account every time you pay. Spend €2.20 on coffee? €0.80 goes straight into your Savings Account, helping you grow your money effortlessly with compound interest.

Save the change

Auto Round Up adds your spare change to your Savings Account every time you pay. Spend €2.20 on coffee? €0.80 goes straight into your Savings Account, helping you grow your money effortlessly with compound interest.

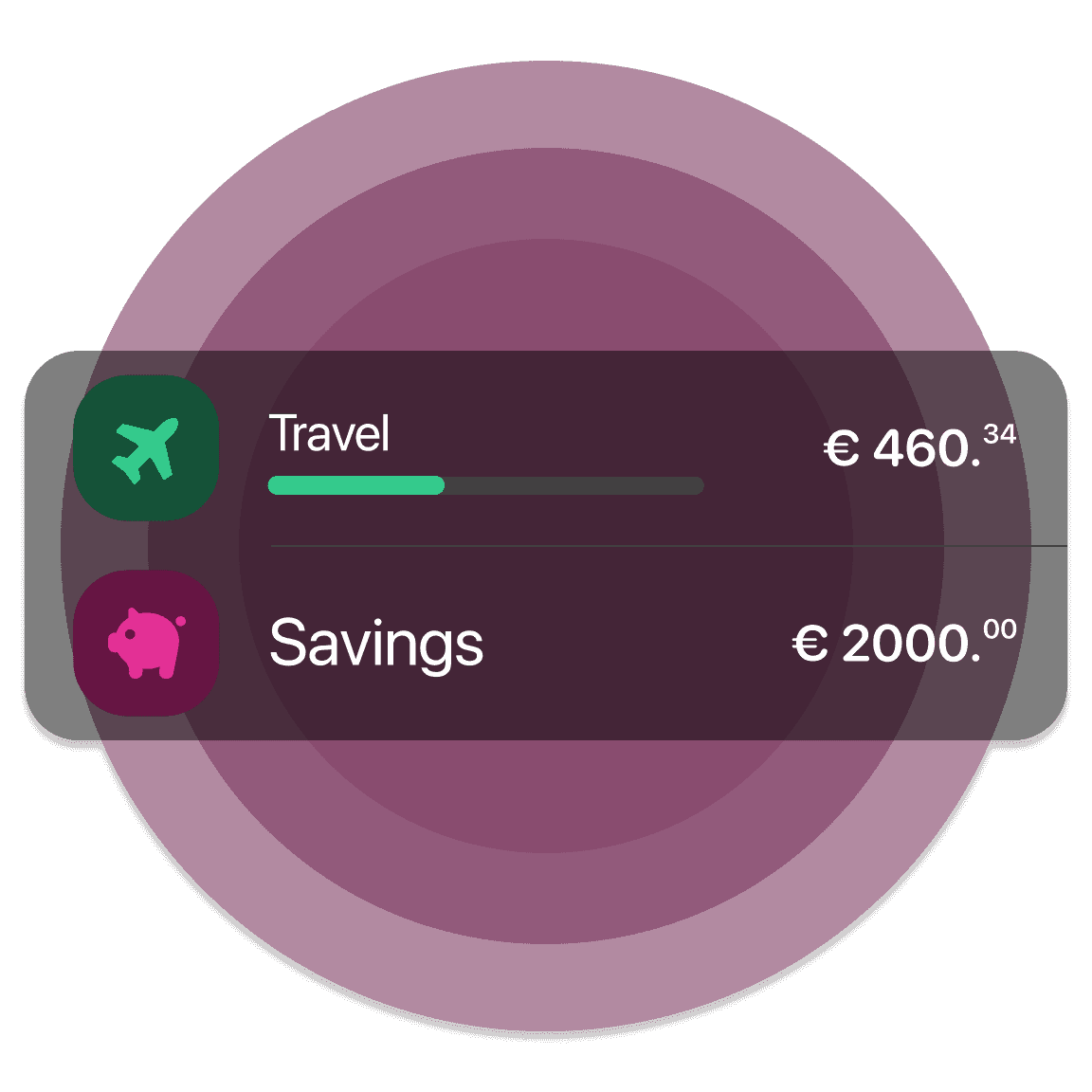

Sort incoming payments

Automatically sort incoming payments into the right Savings Accounts. Set up custom rules to split your money and send it exactly where you need it so you can grow your savings with ease.

Sort incoming payments

Automatically sort incoming payments into the right Savings Accounts. Set up custom rules to split your money and send it exactly where you need it so you can grow your savings with ease.

Sort incoming payments

Automatically sort incoming payments into the right Savings Accounts. Set up custom rules to split your money and send it exactly where you need it so you can grow your savings with ease.

Joint Savings Account

Open a Joint Savings Account in seconds and save together effortlessly. Enjoy all the benefits of a regular Savings Account—including 2.01% annual interest—while sharing legal ownership. Ideal for partners, friends, or families.

Joint Savings Account

Open a Joint Savings Account in seconds and save together effortlessly. Enjoy all the benefits of a regular Savings Account—including 2.01% annual interest—while sharing legal ownership. Ideal for partners, friends, or families.

Joint Savings Account

Open a Joint Savings Account in seconds and save together effortlessly. Enjoy all the benefits of a regular Savings Account—including 2.01% annual interest—while sharing legal ownership. Ideal for partners, friends, or families.

Watch your savings grow

Stay on track of your savings. See how much you could earn with the Savings Calculator right in the Savings Tab.

Watch your savings grow

Stay on track of your savings. See how much you could earn with the Savings Calculator right in the Savings Tab.

Watch your savings grow

Stay on track of your savings. See how much you could earn with the Savings Calculator right in the Savings Tab.

Up to 3 free withdrawals a month

You can withdraw any amount, up to 2 times each month, completely free. Save with bunq for a year and you’ll unlock 3 free monthly withdrawals, giving you even more freedom when you need it.

Up to 3 free withdrawals a month

You can withdraw any amount, up to 2 times each month, completely free. Save with bunq for a year and you’ll unlock 3 free monthly withdrawals, giving you even more freedom when you need it.

Up to 3 free withdrawals a month

You can withdraw any amount, up to 2 times each month, completely free. Save with bunq for a year and you’ll unlock 3 free monthly withdrawals, giving you even more freedom when you need it.

Adding money is easy

Add funds with bank transfers, local payment methods like iDEAL and Instant Bank Transfer, or use Apple Pay, Google Pay, and credit cards.

Adding money is easy

Add funds with bank transfers, local payment methods like iDEAL and Instant Bank Transfer, or use Apple Pay, Google Pay, and credit cards.

Adding money is easy

Add funds with bank transfers, local payment methods like iDEAL and Instant Bank Transfer, or use Apple Pay, Google Pay, and credit cards.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Frequently Asked Questions

Can I open multiple savings accounts?

Yes! With a bunq Pro or bunq Elite account, you can create up to 25 savings accounts, each with its own unique IBAN. This allows you to send and receive money independently and take full control of your budget. You can also personalize each account and group them as needed for a clear and organized financial overview.

Yes! With a bunq Pro or bunq Elite account, you can create up to 25 savings accounts, each with its own unique IBAN. This allows you to send and receive money independently and take full control of your budget. You can also personalize each account and group them as needed for a clear and organized financial overview.

Can I withdraw funds from my savings account at any time?

Yes, you can withdraw funds from your bunq Savings Account, but to encourage saving, withdrawals are limited to 2 per calendar month. You can withdraw the full balance or just a partial amount—it’s completely up to you. Here are a few key points to keep in mind: The 2-withdrawal limit applies to all your bunq Savings Accounts combined. The limit resets automatically on the 1st of each month at 01:00am CET. You’re free to close your Savings Account at any time after moving your money out.

How does bunq ensure my savings are safe?

Your Euro savings are protected by the Dutch Deposit Guarantee Scheme (DGS), which insures deposits up to €100,000 per account holder across all bunq accounts (excluding investments in stocks and crypto). This guarantee ensures that your money is secure while you save with bunq.

How to open a Joint Savings Account?

With a Joint Savings Account, you can easily save together with your friends, family or partners and receive a high MassInterest rate.

How do I create a Joint Account?

Go to the 🏠 Home tab

Tap on 🟣 +Add

Tap on 🟢 Add Bank Account

Tap on Joint Savings Account

Select Partner(s)

Personalize your account

Done! ✅

Frequently Asked Questions

Can I open multiple savings accounts?

Yes! With a bunq Pro or bunq Elite account, you can create up to 25 savings accounts, each with its own unique IBAN. This allows you to send and receive money independently and take full control of your budget. You can also personalize each account and group them as needed for a clear and organized financial overview.

Yes! With a bunq Pro or bunq Elite account, you can create up to 25 savings accounts, each with its own unique IBAN. This allows you to send and receive money independently and take full control of your budget. You can also personalize each account and group them as needed for a clear and organized financial overview.

Can I withdraw funds from my savings account at any time?

Yes, you can withdraw funds from your bunq Savings Account, but to encourage saving, withdrawals are limited to 2 per calendar month. You can withdraw the full balance or just a partial amount—it’s completely up to you. Here are a few key points to keep in mind: The 2-withdrawal limit applies to all your bunq Savings Accounts combined. The limit resets automatically on the 1st of each month at 01:00am CET. You’re free to close your Savings Account at any time after moving your money out.

How does bunq ensure my savings are safe?

Your Euro savings are protected by the Dutch Deposit Guarantee Scheme (DGS), which insures deposits up to €100,000 per account holder across all bunq accounts (excluding investments in stocks and crypto). This guarantee ensures that your money is secure while you save with bunq.

How to open a Joint Savings Account?

With a Joint Savings Account, you can easily save together with your friends, family or partners and receive a high MassInterest rate.

How do I create a Joint Account?

Go to the 🏠 Home tab

Tap on 🟣 +Add

Tap on 🟢 Add Bank Account

Tap on Joint Savings Account

Select Partner(s)

Personalize your account

Done! ✅

Frequently Asked Questions

Can I open multiple savings accounts?

Yes! With a bunq Pro or bunq Elite account, you can create up to 25 savings accounts, each with its own unique IBAN. This allows you to send and receive money independently and take full control of your budget. You can also personalize each account and group them as needed for a clear and organized financial overview.

Yes! With a bunq Pro or bunq Elite account, you can create up to 25 savings accounts, each with its own unique IBAN. This allows you to send and receive money independently and take full control of your budget. You can also personalize each account and group them as needed for a clear and organized financial overview.

Can I withdraw funds from my savings account at any time?

Yes, you can withdraw funds from your bunq Savings Account, but to encourage saving, withdrawals are limited to 2 per calendar month. You can withdraw the full balance or just a partial amount—it’s completely up to you. Here are a few key points to keep in mind: The 2-withdrawal limit applies to all your bunq Savings Accounts combined. The limit resets automatically on the 1st of each month at 01:00am CET. You’re free to close your Savings Account at any time after moving your money out.

How does bunq ensure my savings are safe?

Your Euro savings are protected by the Dutch Deposit Guarantee Scheme (DGS), which insures deposits up to €100,000 per account holder across all bunq accounts (excluding investments in stocks and crypto). This guarantee ensures that your money is secure while you save with bunq.

How to open a Joint Savings Account?

With a Joint Savings Account, you can easily save together with your friends, family or partners and receive a high MassInterest rate.

How do I create a Joint Account?

Go to the 🏠 Home tab

Tap on 🟣 +Add

Tap on 🟢 Add Bank Account

Tap on Joint Savings Account

Select Partner(s)

Personalize your account

Done! ✅

Choose your plan

Try it free for 30 days, no strings attached.

bunq Free

Free

The essentials to get you started.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account that makes budgeting easy.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Choose your plan

Try it free for 30 days, no strings attached.

bunq Free

Free

The essentials to get you started.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account that makes budgeting easy.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Choose your plan

Try it free for 30 days, no strings attached.

bunq Free

Free

The essentials to get you started.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account that makes budgeting easy.

bunq Elite

€18.99/month

The bank account designed for your international lifestyle.

Open your Bank Account in 5 minutes

Get started now, with just your phone and ID.

Open your Bank Account in 5 minutes

Get started now, with just your phone and ID.

Open your Bank Account in 5 minutes

Get started now, with just your phone and ID.

Related Articles

Check out some of these blog posts, packed with useful insights and tips to help you bank smarter and make life easy.

Related Articles

Check out some of these blog posts, packed with useful insights and tips to help you bank smarter and make life easy.

Related Articles

Check out some of these blog posts, packed with useful insights and tips to help you bank smarter and make life easy.