Business Bank Account

Open a Business Account in minutes. 100% online, no paperwork. Get set up for success - fast, simple, stress-free.

Business Bank Account

Open a Business Account in minutes. 100% online, no paperwork. Get set up for success - fast, simple, stress-free.

Business Bank Account

Open a Business Account in minutes. 100% online, no paperwork. Get set up for success - fast, simple, stress-free.

Full-fledged banking for your Business

Up to 25 different accounts, checking or savings, with their own IBANs.

Corporate debit, credit & Company Cards.

Send and receive payments all across the world.

Hold and exchange 20+ currencies at competitive rates.

Your books are always up to date with 50+ bookkeeping integrations.

Full-fledged banking for your Business

Up to 25 different accounts, checking or savings, with their own IBANs.

Corporate debit, credit & Company Cards.

Send and receive payments all across the world.

Hold and exchange 20+ currencies at competitive rates.

Your books are always up to date with 50+ bookkeeping integrations.

Full-fledged banking for your Business

Up to 25 different accounts, checking or savings, with their own IBANs.

Corporate debit, credit & Company Cards.

Send and receive payments all across the world.

Hold and exchange 20+ currencies at competitive rates.

Your books are always up to date with 50+ bookkeeping integrations.

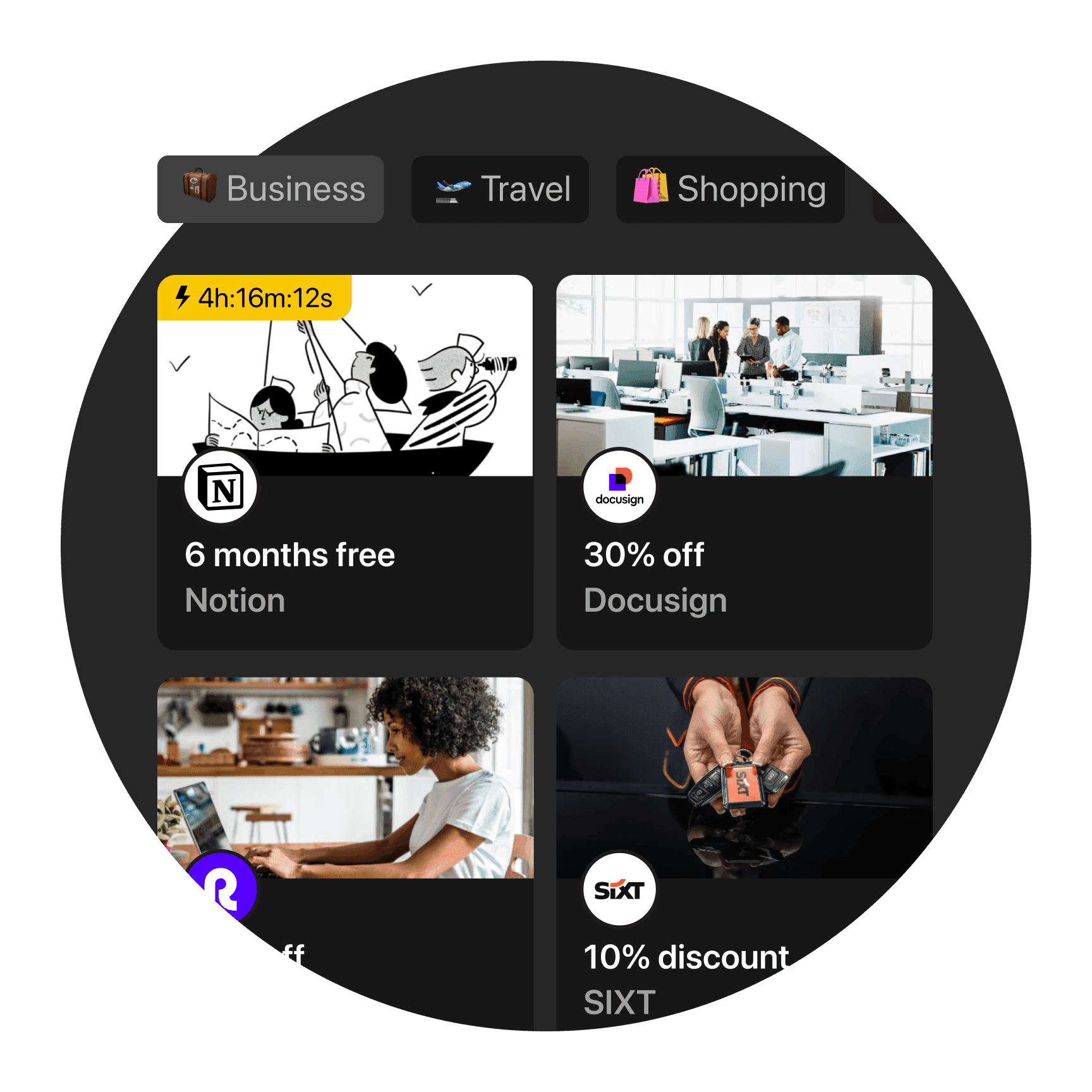

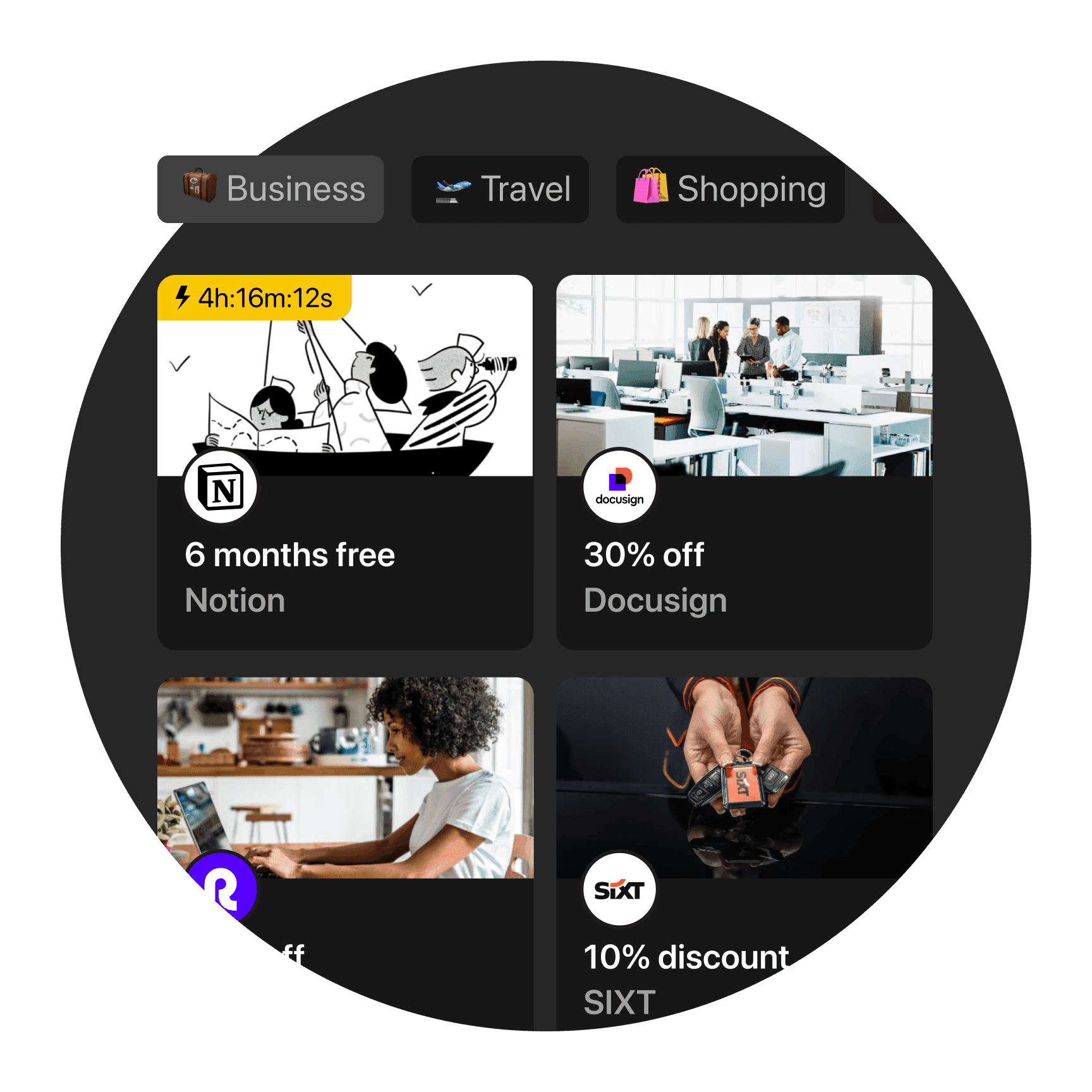

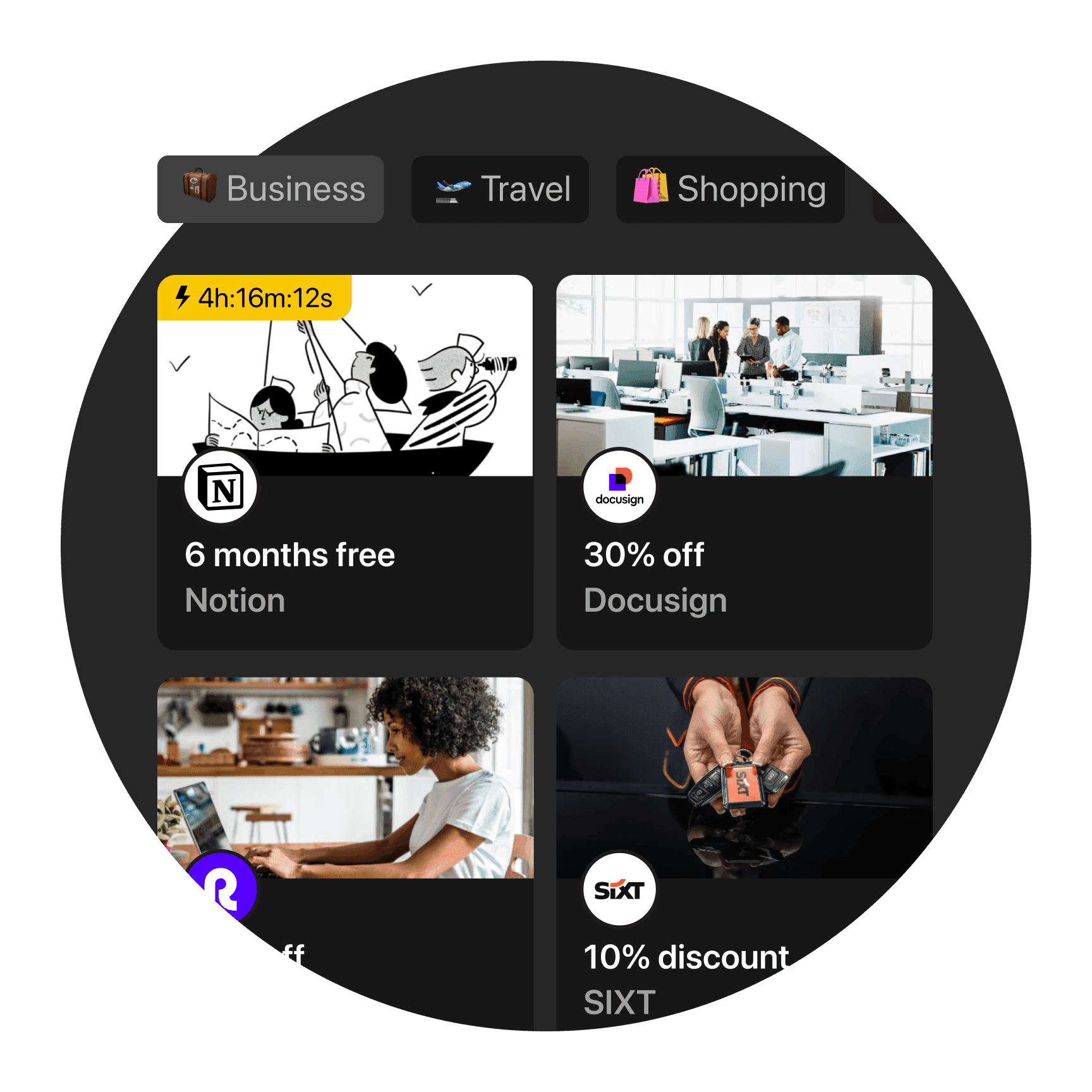

Get more from every business card payments

Unlock exclusive deals for your business! Enjoy discounts with top merchants like Google Workspace, Sixt, Docusign, and many more. Boost productivity and save on essential tools you already love.

Get more from every business card payments

Unlock exclusive deals for your business! Enjoy discounts with top merchants like Google Workspace, Sixt, Docusign, and many more. Boost productivity and save on essential tools you already love.

Get more from every business card payments

Unlock exclusive deals for your business! Enjoy discounts with top merchants like Google Workspace, Sixt, Docusign, and many more. Boost productivity and save on essential tools you already love.

Free for Freelancers

Everything you need to manage your freelance business—completely free. Open multiple bank accounts, get a digital credit card, and send or receive payments in 30+ currencies.

Free for Freelancers

Everything you need to manage your freelance business—completely free. Open multiple bank accounts, get a digital credit card, and send or receive payments in 30+ currencies.

Free for Freelancers

Everything you need to manage your freelance business—completely free. Open multiple bank accounts, get a digital credit card, and send or receive payments in 30+ currencies.

Accept payments from your phone

Easily accept card payments in person, wherever you are. Every bunq Business account includes a built-in card reader through Tap to Pay for iPhone and Google Play.

Accept payments from your phone

Easily accept card payments in person, wherever you are. Every bunq Business account includes a built-in card reader through Tap to Pay for iPhone and Google Play.

Accept payments from your phone

Easily accept card payments in person, wherever you are. Every bunq Business account includes a built-in card reader through Tap to Pay for iPhone and Google Play.

Employee Expense Management

Keep track of employee expenses in real-time. Set limits, request receipts from employees and automate with your accounting software. All in one place.

Employee Expense Management

Keep track of employee expenses in real-time. Set limits, request receipts from employees and automate with your accounting software. All in one place.

Employee Expense Management

Keep track of employee expenses in real-time. Set limits, request receipts from employees and automate with your accounting software. All in one place.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Choose your plan

bunq Free Business

Free for Sole Proprietors

The business bank account that gets you started.

bunq Core Business

€7.99/month

Everything you need to run your business.

bunq Pro Business

€13.99/month

Everything you need to scale your business.

bunq Elite Business

€23.99/month

Next level banking for your international business.

Choose your plan

bunq Free Business

Free for Sole Proprietors

The business bank account that gets you started.

bunq Core Business

€7.99/month

Everything you need to run your business.

bunq Pro Business

€13.99/month

Everything you need to scale your business.

bunq Elite Business

€23.99/month

Next level banking for your international business.

Choose your plan

bunq Free Business

Free for Sole Proprietors

The business bank account that gets you started.

bunq Core Business

€7.99/month

Everything you need to run your business.

bunq Pro Business

€13.99/month

Everything you need to scale your business.

bunq Elite Business

€23.99/month

Next level banking for your international business.

Frequently Asked Questions

How to open a business bank account with bunq?

For new users, here’s how to get started:

Download the bunq app

Click on Try for free

Choose your interests for a Personal account, then scroll down to select the features for a Business account as well

Add your personal information

Add your business information

Identify yourself

Complete your Business account signup by providing the additional requested business information via the app

Our KYC team will review your application and let you know if we need more information about your company. We’ll keep you updated!

The moment you’ve applied for your bunq Business account, we’ll get to work in order to verify it for you.

For new users, here’s how to get started:

Download the bunq app

Click on Try for free

Choose your interests for a Personal account, then scroll down to select the features for a Business account as well

Add your personal information

Add your business information

Identify yourself

Complete your Business account signup by providing the additional requested business information via the app

Our KYC team will review your application and let you know if we need more information about your company. We’ll keep you updated!

The moment you’ve applied for your bunq Business account, we’ll get to work in order to verify it for you.

What company information is needed to open a business bank account?

In order to open a business account with bunq, you need to provide a legal form together with a few documents.

For each legal form, we require the following documents.

Eenmanszaak

n/a

Besloten Vennootschap

Deed of Incorporation (DOI)

Joint authorisation (if the directors are jointly authorised)

IDs of all directors and UBOs (only in some cases)

Record of shareholders (only in some cases)

Stichting

Deed of Incorporation (DOI)

Joint authorisation (if the directors are jointly authorised)

IDs of all founders, directors and UBOs (only in some cases)

UBO form using our template (only in some cases)

Vennootschap onder firma

Joint authorisation (if the directors are jointly authorised)

IDs of all founders, directors and UBOs (only in some cases)

UBO form using our template (only in some cases)

Maatschap

Joint authorisation (if the directors are jointly authorised)

IDs of all founders, directors and UBOs (only in some cases)

UBO form using our template (only in some cases)

Vereniging / Vereniging van eigenaars

Joint authorisation (if the directors are jointly authorised)

IDs of all founders, directors and UBOs (only in some cases)

UBO form using our template (only in some cases)

What legal forms are accepted?

We accept the following legal forms:

Entreprise Individuelle

Société à responsabilité limitée (SARL)

Entreprise unipersonnelle à responsabilité limitée (EURL)

Société par Actions Simplifiée (SAS)

Société par Actions Simplifiée Unipersonnelle (SASU)

Why do I need to provide business activity information?

At bunq, we make sure your money is 100% safe and follow regulatory procedures in order to do so. As part of our Know Your Customer (KYC) duties, we may reach out to you for some additional account information in order to fulfill our customer due diligence requirements as a bank.

Can I add multiple Co-founders or directors to the business bank account?

You can add up to 3 co-founders or company directors when you have the bunq Core, Pro or Elite subscription. Account Co-founders have complete access to the company accounts and can add or remove other Account Co-founders directly within the app.

Why do you need a personal account with your business account?

To keep everything secure and compliant with regulations, we need to know exactly who’s making transactions at any time.

That’s why, to open a Business account, you’ll need to have a verified Personal account, which you can create simultaneously during the signup flow. Your Business account will then be accessible using your Personal account credentials, ensuring everything stays safe and streamlined.

Frequently Asked Questions

How to open a business bank account with bunq?

For new users, here’s how to get started:

Download the bunq app

Click on Try for free

Choose your interests for a Personal account, then scroll down to select the features for a Business account as well

Add your personal information

Add your business information

Identify yourself

Complete your Business account signup by providing the additional requested business information via the app

Our KYC team will review your application and let you know if we need more information about your company. We’ll keep you updated!

The moment you’ve applied for your bunq Business account, we’ll get to work in order to verify it for you.

For new users, here’s how to get started:

Download the bunq app

Click on Try for free

Choose your interests for a Personal account, then scroll down to select the features for a Business account as well

Add your personal information

Add your business information

Identify yourself

Complete your Business account signup by providing the additional requested business information via the app

Our KYC team will review your application and let you know if we need more information about your company. We’ll keep you updated!

The moment you’ve applied for your bunq Business account, we’ll get to work in order to verify it for you.

What company information is needed to open a business bank account?

In order to open a business account with bunq, you need to provide a legal form together with a few documents.

For each legal form, we require the following documents.

Eenmanszaak

n/a

Besloten Vennootschap

Deed of Incorporation (DOI)

Joint authorisation (if the directors are jointly authorised)

IDs of all directors and UBOs (only in some cases)

Record of shareholders (only in some cases)

Stichting

Deed of Incorporation (DOI)

Joint authorisation (if the directors are jointly authorised)

IDs of all founders, directors and UBOs (only in some cases)

UBO form using our template (only in some cases)

Vennootschap onder firma

Joint authorisation (if the directors are jointly authorised)

IDs of all founders, directors and UBOs (only in some cases)

UBO form using our template (only in some cases)

Maatschap

Joint authorisation (if the directors are jointly authorised)

IDs of all founders, directors and UBOs (only in some cases)

UBO form using our template (only in some cases)

Vereniging / Vereniging van eigenaars

Joint authorisation (if the directors are jointly authorised)

IDs of all founders, directors and UBOs (only in some cases)

UBO form using our template (only in some cases)

What legal forms are accepted?

We accept the following legal forms:

Entreprise Individuelle

Société à responsabilité limitée (SARL)

Entreprise unipersonnelle à responsabilité limitée (EURL)

Société par Actions Simplifiée (SAS)

Société par Actions Simplifiée Unipersonnelle (SASU)

Why do I need to provide business activity information?

At bunq, we make sure your money is 100% safe and follow regulatory procedures in order to do so. As part of our Know Your Customer (KYC) duties, we may reach out to you for some additional account information in order to fulfill our customer due diligence requirements as a bank.

Can I add multiple Co-founders or directors to the business bank account?

You can add up to 3 co-founders or company directors when you have the bunq Core, Pro or Elite subscription. Account Co-founders have complete access to the company accounts and can add or remove other Account Co-founders directly within the app.

Why do you need a personal account with your business account?

To keep everything secure and compliant with regulations, we need to know exactly who’s making transactions at any time.

That’s why, to open a Business account, you’ll need to have a verified Personal account, which you can create simultaneously during the signup flow. Your Business account will then be accessible using your Personal account credentials, ensuring everything stays safe and streamlined.

Frequently Asked Questions

How to open a business bank account with bunq?

For new users, here’s how to get started:

Download the bunq app

Click on Try for free

Choose your interests for a Personal account, then scroll down to select the features for a Business account as well

Add your personal information

Add your business information

Identify yourself

Complete your Business account signup by providing the additional requested business information via the app

Our KYC team will review your application and let you know if we need more information about your company. We’ll keep you updated!

The moment you’ve applied for your bunq Business account, we’ll get to work in order to verify it for you.

For new users, here’s how to get started:

Download the bunq app

Click on Try for free

Choose your interests for a Personal account, then scroll down to select the features for a Business account as well

Add your personal information

Add your business information

Identify yourself

Complete your Business account signup by providing the additional requested business information via the app

Our KYC team will review your application and let you know if we need more information about your company. We’ll keep you updated!

The moment you’ve applied for your bunq Business account, we’ll get to work in order to verify it for you.

What company information is needed to open a business bank account?

In order to open a business account with bunq, you need to provide a legal form together with a few documents.

For each legal form, we require the following documents.

Eenmanszaak

n/a

Besloten Vennootschap

Deed of Incorporation (DOI)

Joint authorisation (if the directors are jointly authorised)

IDs of all directors and UBOs (only in some cases)

Record of shareholders (only in some cases)

Stichting

Deed of Incorporation (DOI)

Joint authorisation (if the directors are jointly authorised)

IDs of all founders, directors and UBOs (only in some cases)

UBO form using our template (only in some cases)

Vennootschap onder firma

Joint authorisation (if the directors are jointly authorised)

IDs of all founders, directors and UBOs (only in some cases)

UBO form using our template (only in some cases)

Maatschap

Joint authorisation (if the directors are jointly authorised)

IDs of all founders, directors and UBOs (only in some cases)

UBO form using our template (only in some cases)

Vereniging / Vereniging van eigenaars

Joint authorisation (if the directors are jointly authorised)

IDs of all founders, directors and UBOs (only in some cases)

UBO form using our template (only in some cases)

What legal forms are accepted?

We accept the following legal forms:

Entreprise Individuelle

Société à responsabilité limitée (SARL)

Entreprise unipersonnelle à responsabilité limitée (EURL)

Société par Actions Simplifiée (SAS)

Société par Actions Simplifiée Unipersonnelle (SASU)

Why do I need to provide business activity information?

At bunq, we make sure your money is 100% safe and follow regulatory procedures in order to do so. As part of our Know Your Customer (KYC) duties, we may reach out to you for some additional account information in order to fulfill our customer due diligence requirements as a bank.

Can I add multiple Co-founders or directors to the business bank account?

You can add up to 3 co-founders or company directors when you have the bunq Core, Pro or Elite subscription. Account Co-founders have complete access to the company accounts and can add or remove other Account Co-founders directly within the app.

Why do you need a personal account with your business account?

To keep everything secure and compliant with regulations, we need to know exactly who’s making transactions at any time.

That’s why, to open a Business account, you’ll need to have a verified Personal account, which you can create simultaneously during the signup flow. Your Business account will then be accessible using your Personal account credentials, ensuring everything stays safe and streamlined.

Open your business bank account in just 5 minutes

Open your business bank account in just 5 minutes

Open your business bank account in just 5 minutes