Banking for modern parents

Open a dedicated Child Account, track spending, and set savings goals together—all in one app.

Banking for modern parents

Open a dedicated Child Account, track spending, and set savings goals together—all in one app.

Banking for modern parents

Open a dedicated Child Account, track spending, and set savings goals together—all in one app.

100% online. No branches. No paperwork.

Open a free bank account for your child from the comfort of your home.

Earn up to 2.01% interest on savings

Start growing your child’s savings with weekly interest payouts.

Real-time insights

Monitor and guide your child’s financial activities with instant notifications and full visibility.

100% online. No branches. No paperwork.

Open a free bank account for your child from the comfort of your home.

Earn up to 2.01% interest on savings

Start growing your child’s savings with weekly interest payouts.

Real-time insights

Monitor and guide your child’s financial activities with instant notifications and full visibility.

100% online. No branches. No paperwork.

Open a free bank account for your child from the comfort of your home.

Earn up to 2.01% interest on savings

Start growing your child’s savings with weekly interest payouts.

Real-time insights

Monitor and guide your child’s financial activities with instant notifications and full visibility.

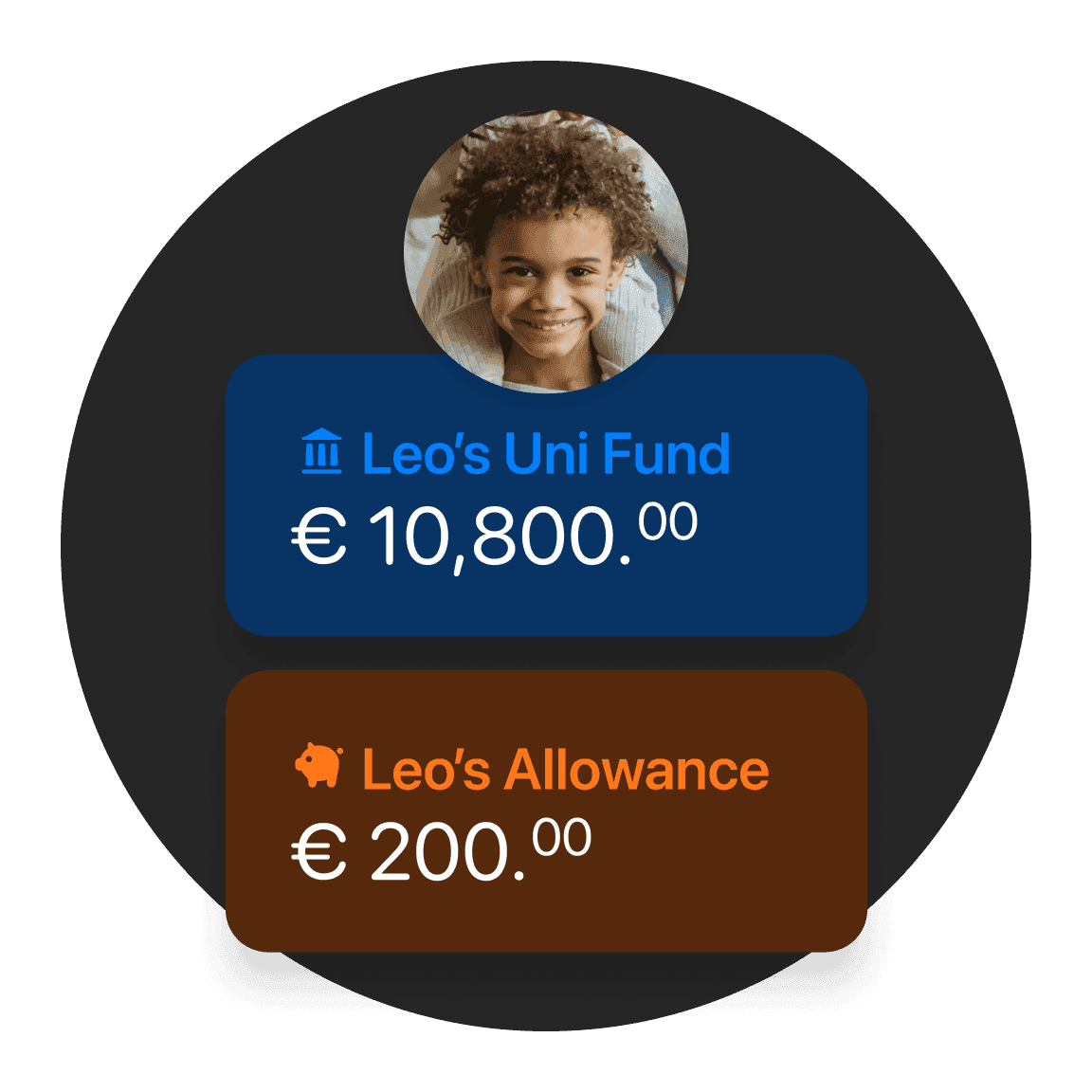

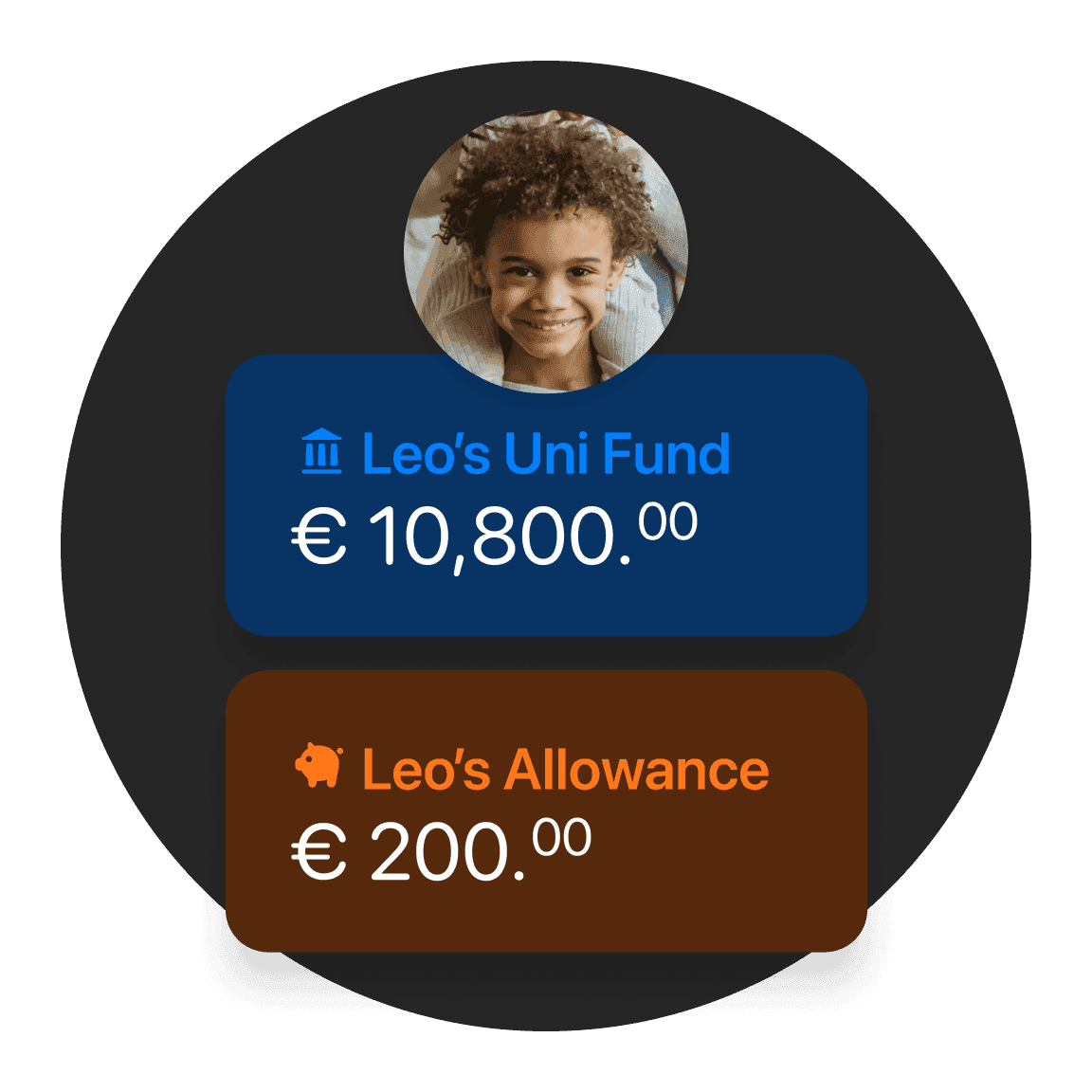

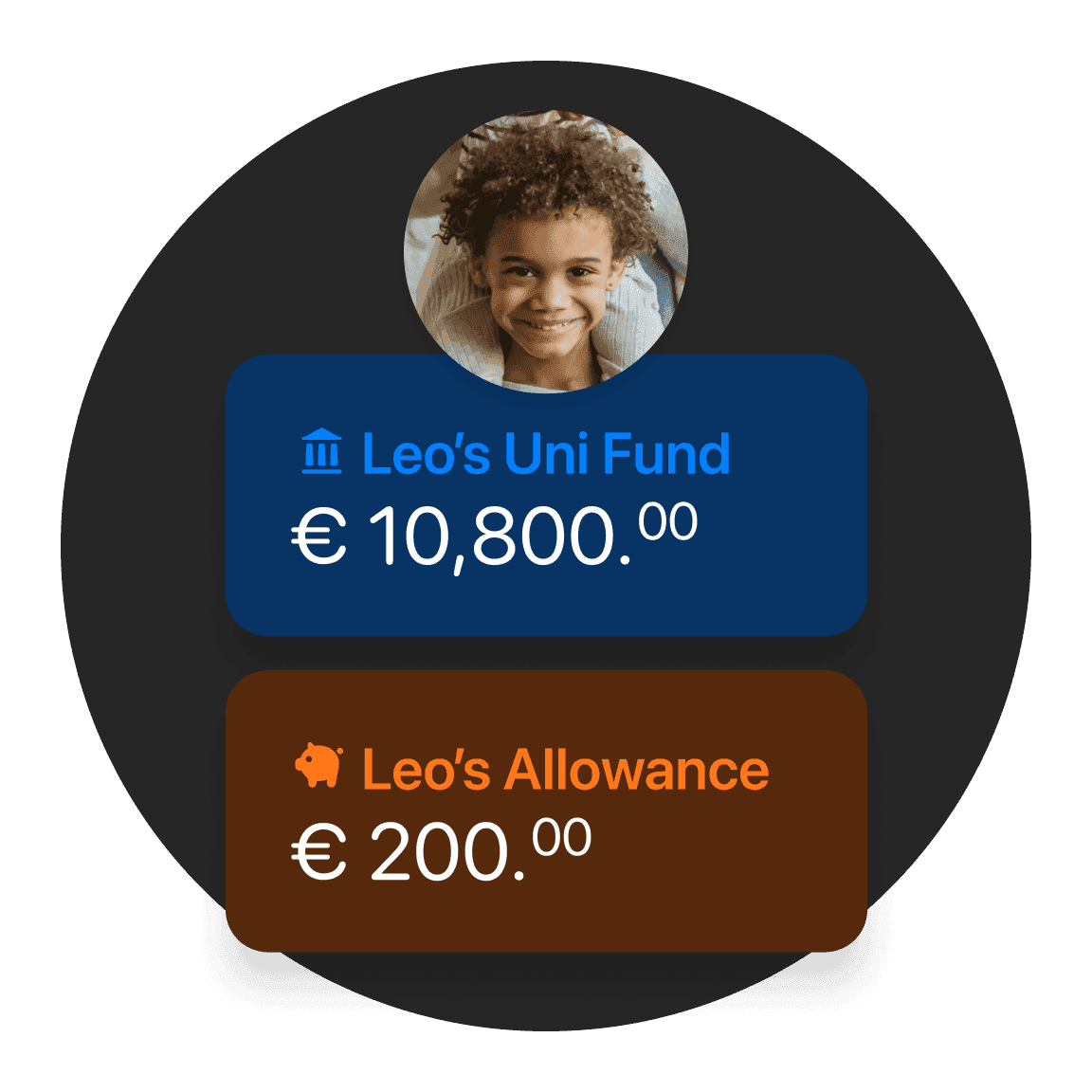

Your child's own bank account

As a bunq Core, Pro, or Elite user, you can help your child grow their money skills. You can also open up to four Child Accounts.

Your child's own bank account

As a bunq Core, Pro, or Elite user, you can help your child grow their money skills. You can also open up to four Child Accounts.

Your child's own bank account

As a bunq Core, Pro, or Elite user, you can help your child grow their money skills. You can also open up to four Child Accounts.

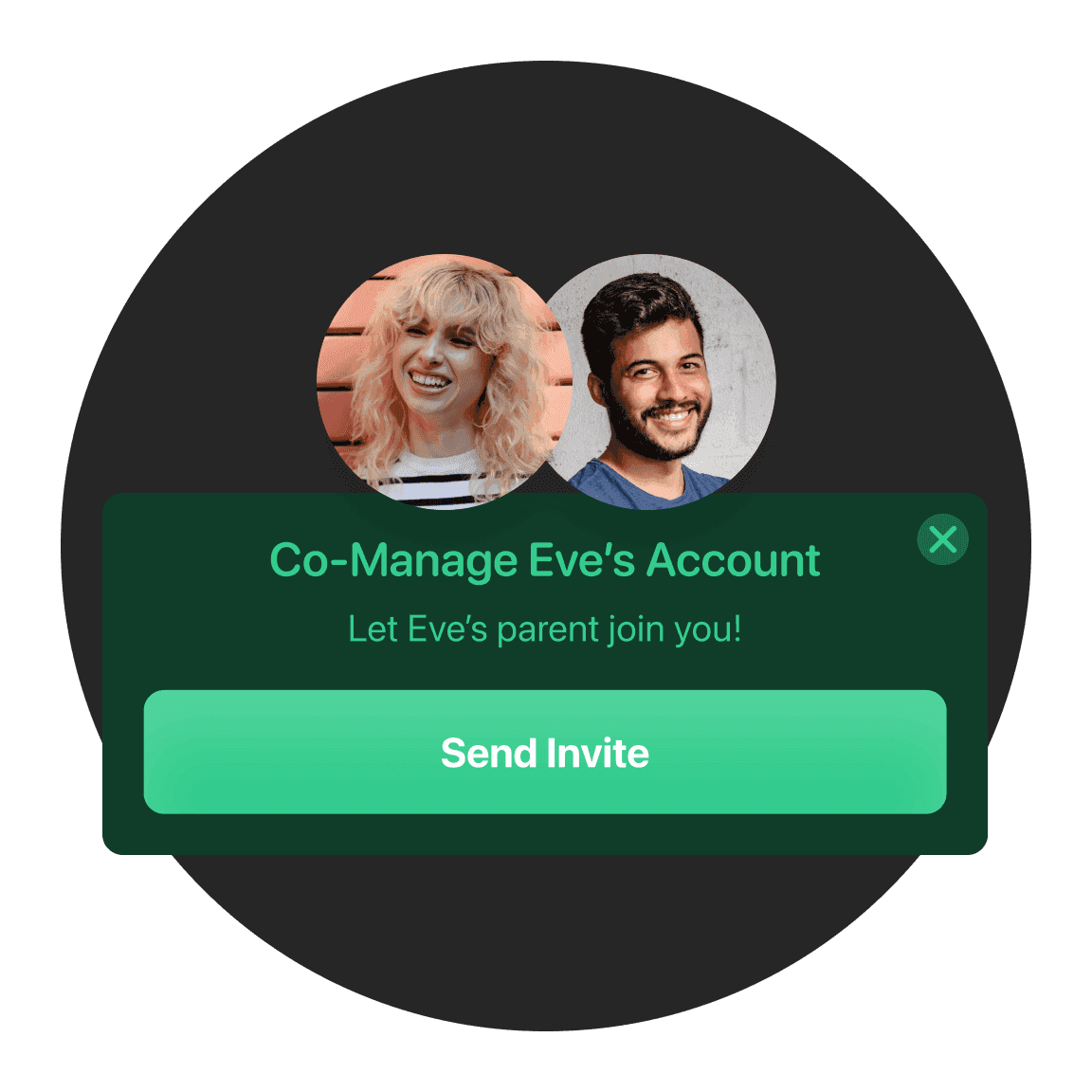

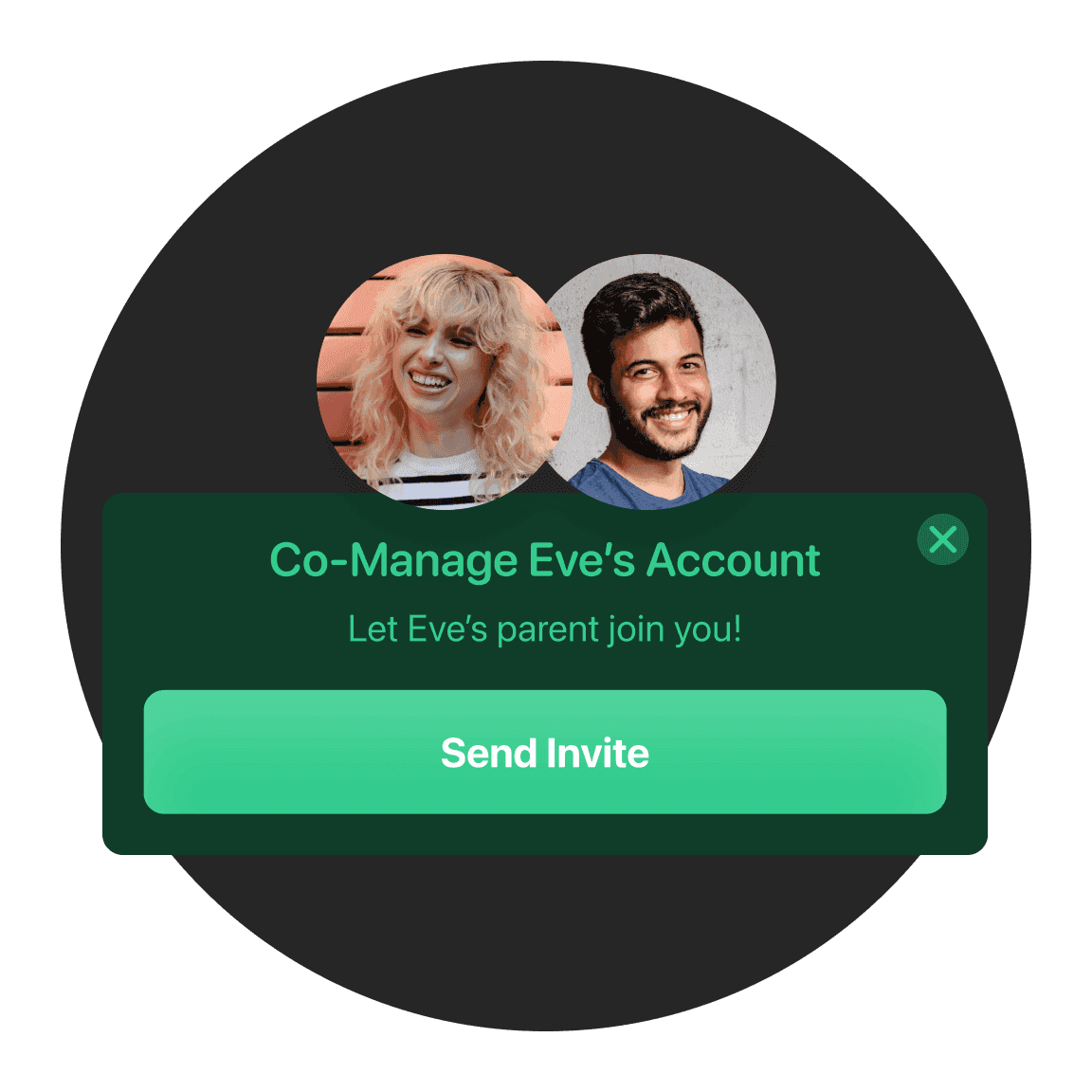

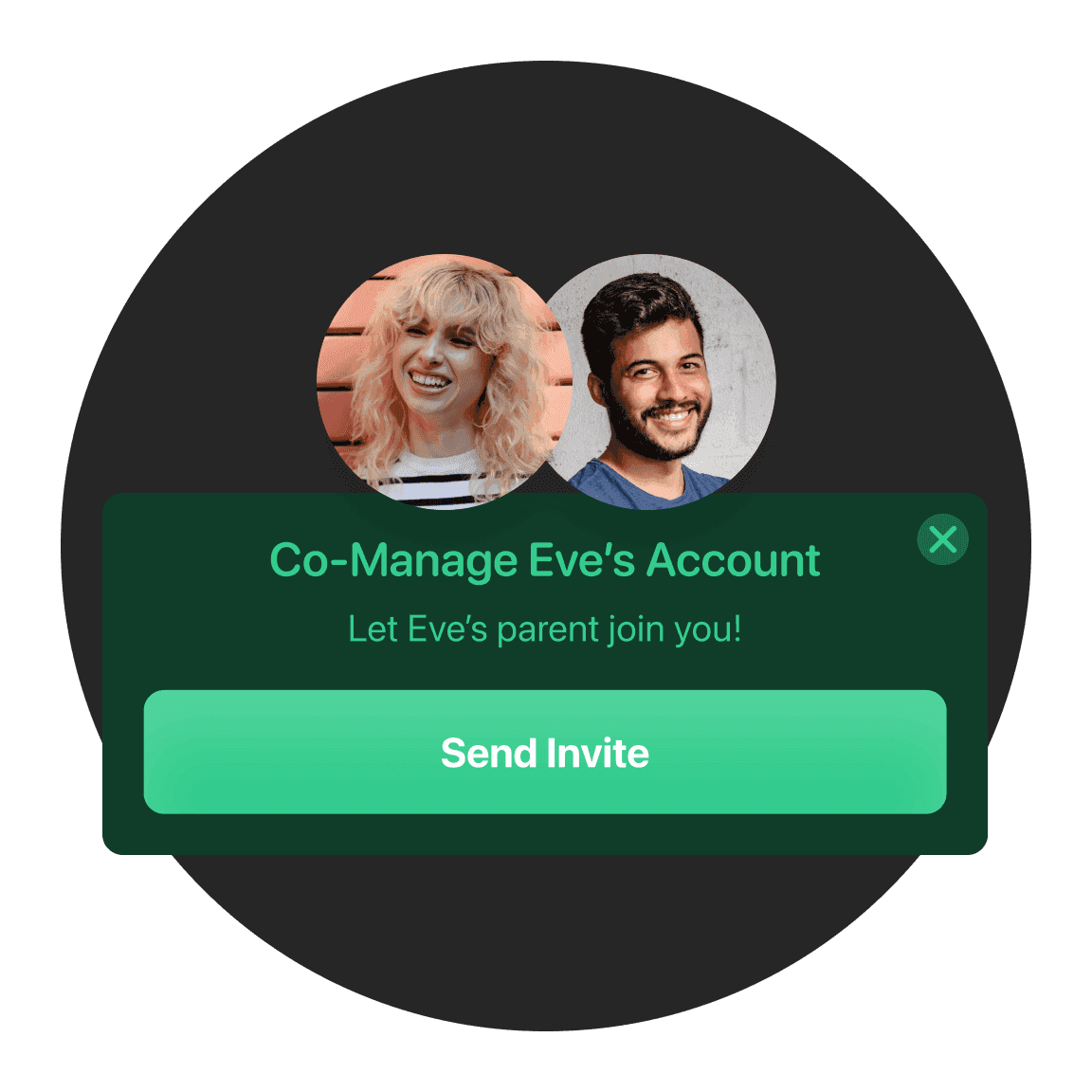

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility with their Child Account.

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility with their Child Account.

Manage your child's account together

Easily share access to your child's account with your partner, so both of you can stay involved in managing their finances. From tracking spending to setting limits, you can work together to help your child build financial responsibility with their Child Account.

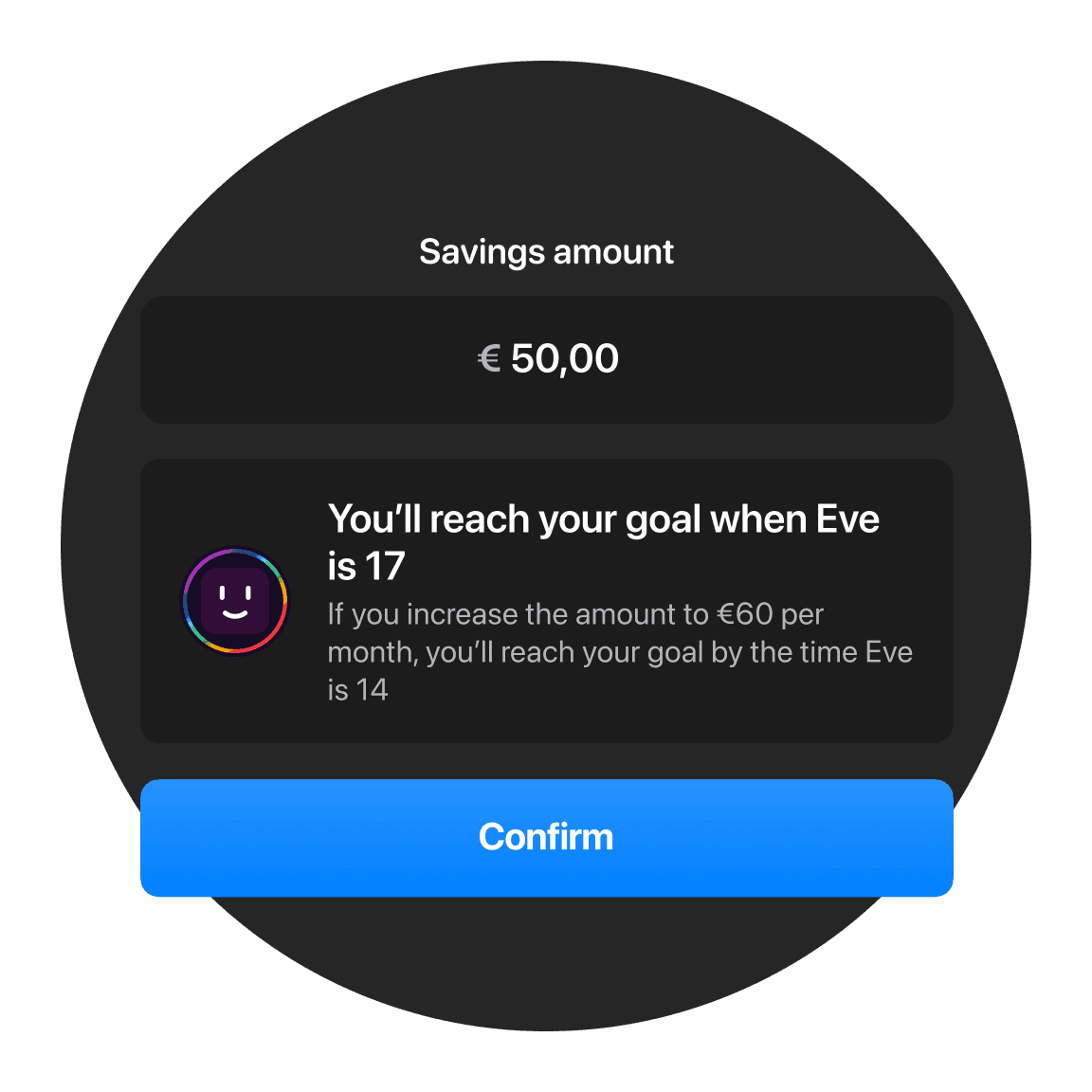

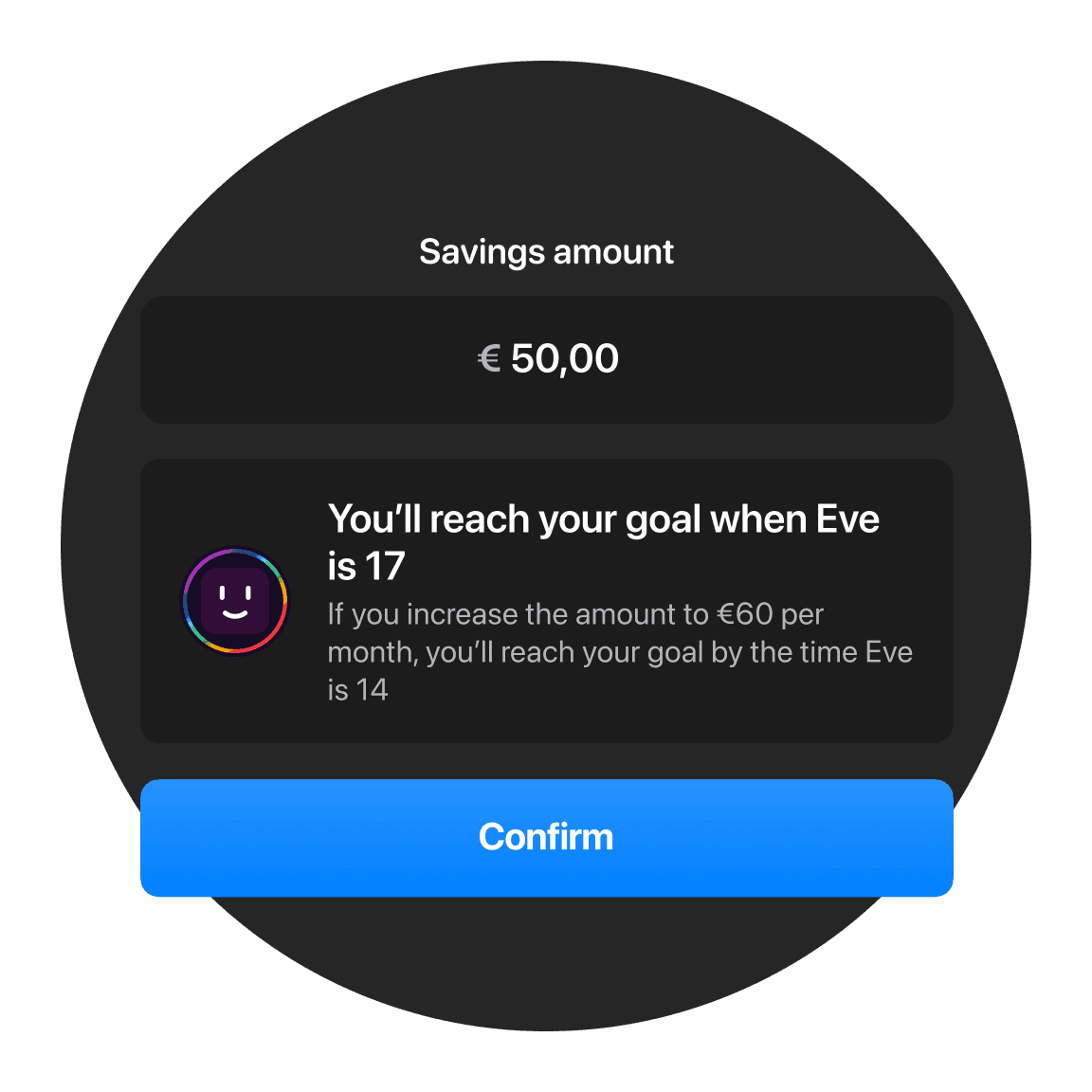

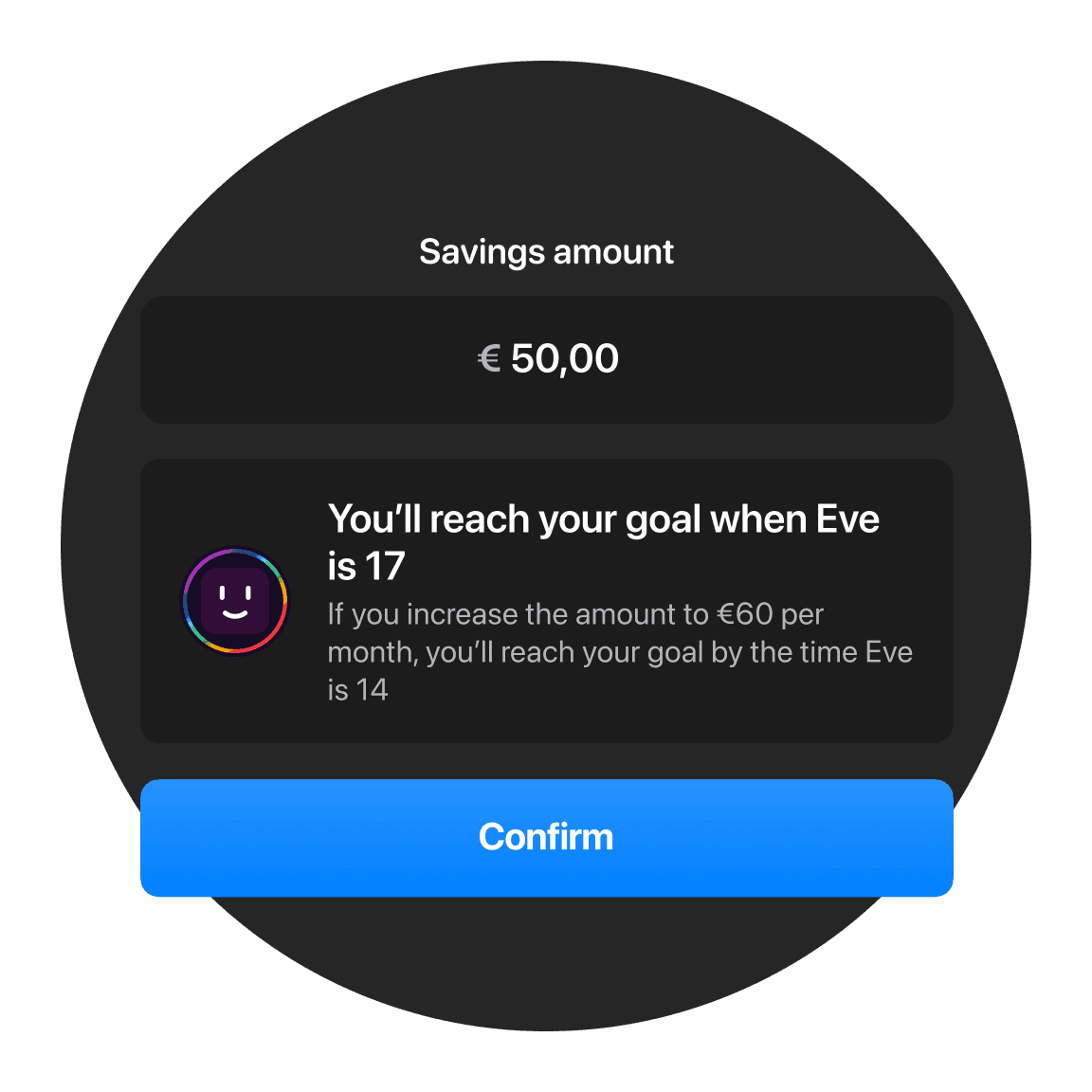

Achieve savings goals faster

Get smart, personalized support from bunq’s AI assistant, Finn. Simply set your goal, and Finn will calculate exactly how much—and how often—you need to save to reach it faster. Accelerate your progress with helpful features like AutoSave, which rounds up daily purchases and saves the difference. Plus, make it easy for friends and family to contribute directly to your child’s savings account with a personalized bunq.me link.

Achieve savings goals faster

Get smart, personalized support from bunq’s AI assistant, Finn. Simply set your goal, and Finn will calculate exactly how much—and how often—you need to save to reach it faster. Accelerate your progress with helpful features like AutoSave, which rounds up daily purchases and saves the difference. Plus, make it easy for friends and family to contribute directly to your child’s savings account with a personalized bunq.me link.

Achieve savings goals faster

Get smart, personalized support from bunq’s AI assistant, Finn. Simply set your goal, and Finn will calculate exactly how much—and how often—you need to save to reach it faster. Accelerate your progress with helpful features like AutoSave, which rounds up daily purchases and saves the difference. Plus, make it easy for friends and family to contribute directly to your child’s savings account with a personalized bunq.me link.

Your child earns up to 2.01%* interest on savings

Give your child a financial head start with a dedicated savings account that earns up to 2.01% interest. With weekly payouts, their savings grow faster—turning small contributions into big results over time.

Your child earns up to 2.01%* interest on savings

Give your child a financial head start with a dedicated savings account that earns up to 2.01% interest. With weekly payouts, their savings grow faster—turning small contributions into big results over time.

Your child earns up to 2.01%* interest on savings

Give your child a financial head start with a dedicated savings account that earns up to 2.01% interest. With weekly payouts, their savings grow faster—turning small contributions into big results over time.

Give them enough independence

You can give your child their own customizable bunq debit card and set spending limits, allowing them to spend responsibly with zero debt risk. You’ll be instantly notified whenever they make a payment.

Give them enough independence

You can give your child their own customizable bunq debit card and set spending limits, allowing them to spend responsibly with zero debt risk. You’ll be instantly notified whenever they make a payment.

Give them enough independence

You can give your child their own customizable bunq debit card and set spending limits, allowing them to spend responsibly with zero debt risk. You’ll be instantly notified whenever they make a payment.

Teach them healthy habits early with easy budgeting

Whether they're saving for a Lego set or a pair of sneakers, the bunq app helps your child build smart saving habits to reach their goal. All the while, you stay in control with smart settings for what they can see and do with their child account.

Teach them healthy habits early with easy budgeting

Whether they're saving for a Lego set or a pair of sneakers, the bunq app helps your child build smart saving habits to reach their goal. All the while, you stay in control with smart settings for what they can see and do with their child account.

Teach them healthy habits early with easy budgeting

Whether they're saving for a Lego set or a pair of sneakers, the bunq app helps your child build smart saving habits to reach their goal. All the while, you stay in control with smart settings for what they can see and do with their child account.

Round up payments and save the difference

With AutoSave, your child's payments are rounded up, and the difference is sent directly to their savings account. For example, if they spend €4.10, €0.90 goes straight to their savings—that simple.

Round up payments and save the difference

With AutoSave, your child's payments are rounded up, and the difference is sent directly to their savings account. For example, if they spend €4.10, €0.90 goes straight to their savings—that simple.

Round up payments and save the difference

With AutoSave, your child's payments are rounded up, and the difference is sent directly to their savings account. For example, if they spend €4.10, €0.90 goes straight to their savings—that simple.

Never forget Pocket Money again

Set up your child’s pocket money once and never worry about it again. No more forgetting or last-minute scrambles. Not sure how much to give? No problem! We’ll suggest an amount that’s typical for your child’s age.

Never forget Pocket Money again

Set up your child’s pocket money once and never worry about it again. No more forgetting or last-minute scrambles. Not sure how much to give? No problem! We’ll suggest an amount that’s typical for your child’s age.

Never forget Pocket Money again

Set up your child’s pocket money once and never worry about it again. No more forgetting or last-minute scrambles. Not sure how much to give? No problem! We’ll suggest an amount that’s typical for your child’s age.

Personal payment link

Your child can set up their personal payment link so that family and friends can easily send them money straight to their child account.

Personal payment link

Your child can set up their personal payment link so that family and friends can easily send them money straight to their child account.

Personal payment link

Your child can set up their personal payment link so that family and friends can easily send them money straight to their child account.

Invite your friends and unlock exclusive rewards

Know someone who needs a bank account? Give them a head start with bunq. When your friend joins, you both receive rewards like a free Metal Card, extra bonus interest, or three months of free stock trading.

Invite your friends and unlock exclusive rewards

Know someone who needs a bank account? Give them a head start with bunq. When your friend joins, you both receive rewards like a free Metal Card, extra bonus interest, or three months of free stock trading.

Invite your friends and unlock exclusive rewards

Know someone who needs a bank account? Give them a head start with bunq. When your friend joins, you both receive rewards like a free Metal Card, extra bonus interest, or three months of free stock trading.

Buy & sell crypto, right where you bank

Get started with crypto right from your bunq app, with industry-leading protection* every step of the way. Choose from the top cryptocurrencies—buying and selling takes just a tap.

Buy & sell crypto, right where you bank

Get started with crypto right from your bunq app, with industry-leading protection* every step of the way. Choose from the top cryptocurrencies—buying and selling takes just a tap.

Buy & sell crypto, right where you bank

Get started with crypto right from your bunq app, with industry-leading protection* every step of the way. Choose from the top cryptocurrencies—buying and selling takes just a tap.

Offset CO2

We’re planting 30 million trees! Spend with your bunq card and earn trees as you go. With veritree, each tree is planted at the right time, in the right place, and carefully tracked as it grows. You’ll be able to follow your trees and see the positive impact they make over time.

Offset CO2

We’re planting 30 million trees! Spend with your bunq card and earn trees as you go. With veritree, each tree is planted at the right time, in the right place, and carefully tracked as it grows. You’ll be able to follow your trees and see the positive impact they make over time.

Offset CO2

We’re planting 30 million trees! Spend with your bunq card and earn trees as you go. With veritree, each tree is planted at the right time, in the right place, and carefully tracked as it grows. You’ll be able to follow your trees and see the positive impact they make over time.

Disclaimer

*Powered by Kraken's Custody service and bunq's Safety Shield.

Disclaimer

*Powered by Kraken's Custody service and bunq's Safety Shield.

Disclaimer

*Powered by Kraken's Custody service and bunq's Safety Shield.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Trusted by millions of users

Join over 20 million users on the bunq platform

Insured up to €100,000

Your money is protected by the Dutch Deposit Guarantee Scheme (DGS).

Card Payment Refunds

Your money is protected if something doesn't go as planned.

Instant Payments

Send and receive money instantly, no waiting.

24/7 support

Instant help in your language, whenever you need it.

Related Articles

Check out some of these blog posts, packed with useful insights and tips to help you bank smarter and make life easy.

Related Articles

Check out some of these blog posts, packed with useful insights and tips to help you bank smarter and make life easy.

Related Articles

Check out some of these blog posts, packed with useful insights and tips to help you bank smarter and make life easy.

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Choose your plan

Try it free for 30 days, no strings attached.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account for you to kickstart your financial journey.

bunq Elite

€18.99/month

The bank account that takes your money to the next level.

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Choose your plan

Try it free for 30 days, no strings attached.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account for you to kickstart your financial journey.

bunq Elite

€18.99/month

The bank account that takes your money to the next level.

Risk indicator for all bunq B.V. accounts

1

/

6

This number is indicative of product risk, with 1/6 indicating lower risk and 6/6 indicating higher risk.

bunq B.V. is adhered to the Dutch Deposit Guarantee Fund. The maximum guaranteed amount is €100,000 per user

Choose your plan

Try it free for 30 days, no strings attached.

bunq Core

€3.99/month

The bank account for everyday use.

bunq Pro

€9.99/month

The bank account for you to kickstart your financial journey.

bunq Elite

€18.99/month

The bank account that takes your money to the next level.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.

Start your 30-day free trial

Open your account in just 5 minutes, directly from your phone.